What’s in this article

- Why Foreigners Should Set Up A Company in Singapore?

- Types of Business Entity for Foreigners

- Work Visas for Foreign Business Owners

- Can foreigner be a director of a Singapore company?

- Requirements for Foreigners to register a Company in Singapore

- Challenges of Company Registration as a Foreigner

- Things to Take Note After Setting Up a Company in Singapore for Foreigners

- Conclusion

- FAQs

One of the more common questions we usually get is “How to register a company in Singapore as a foreigner?”. If you’re asking the same, this article is for you. For starters, you’ll need to know that foreigners can incorporate a company in Singapore and own 100% of its shareholding.

- You will need to engage a registered filing agent (such as a law firm, accounting firm or corporate secretarial firm) to submit the application in BizFile+ on your behalf.

- One of the directors/ authorised representatives/ general partners/managers must be a local resident.

Agents usually provide services, such as:

- Registration of company;

- Provision of Company Secretary;

- Provision of local nominee director;

- Filing Annual Returns with ACRA;

- Maintaining and updating of information with ACRA; etc.

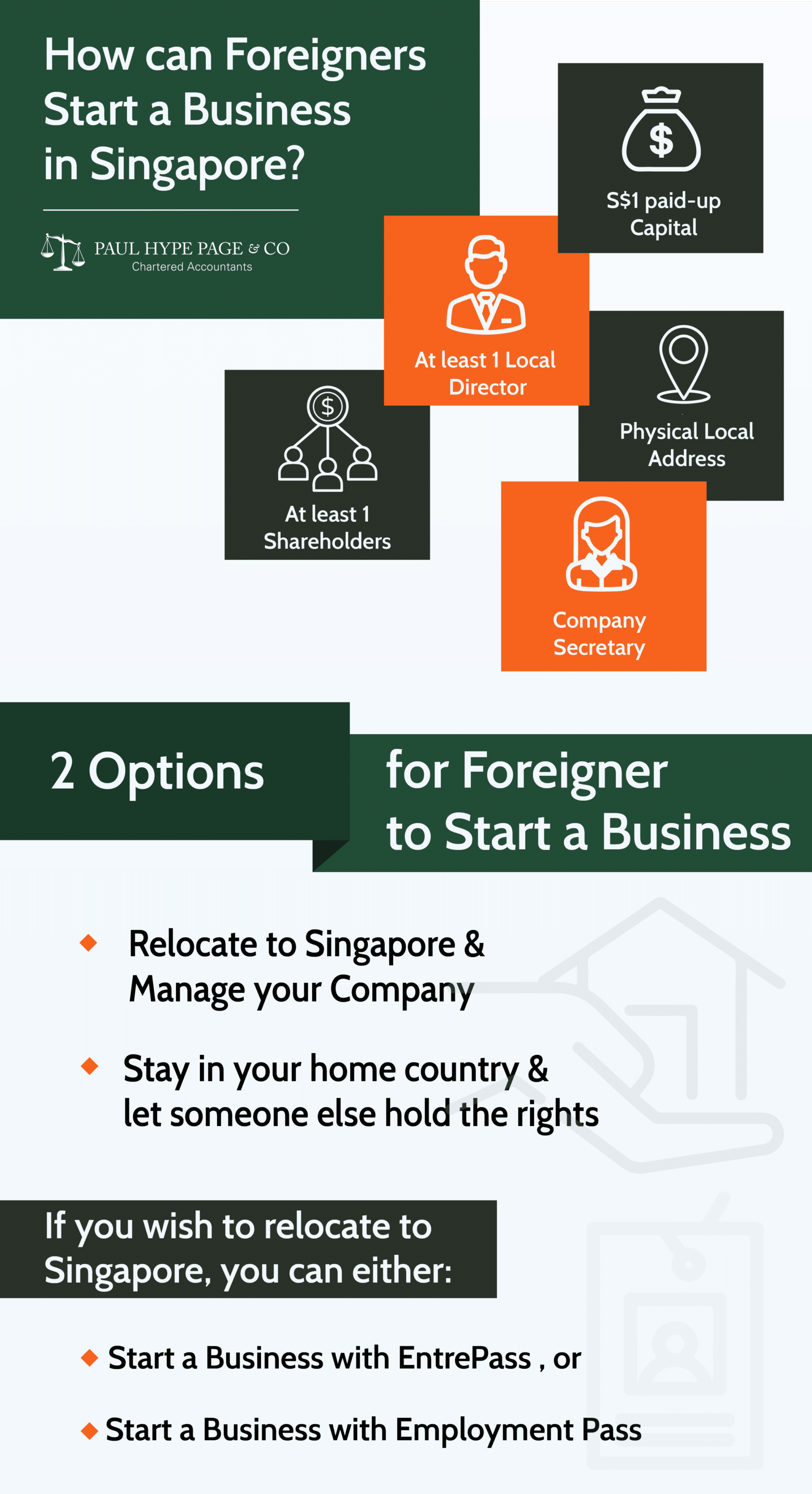

Foreign entrepreneurs or existing Dependant Pass (DP) holders who wish to start a business in Singapore will need to consider:

- Setting up a company with an Employment Pass (EP) or

- Applying for an Entrepreneur Pass (EntrePass)

Why Foreigners Should Set Up A Company in Singapore?

Firstly, Singapore’s law allows local company incorporation to be completely foreign-owned. Parent companies that form Singapore-based subsidiary companies can easily enjoy all the benefits of Singapore incorporation.

Secondly, Singapore has an attractive tax regime. Local companies can take advantage of exemptions and tax breaks to pay a far lower effective rate than 17% (which is Singapore’s flat rate).

Thirdly, Singapore has enjoyed consistent social and political stability as a world class business hub. On a political stability scale from -2.5 to 2.5. Singapore is rated at an average of 1.24.

Types of Business Entity for Foreigners

We’ll focus on the whys here and leave the elaboration in our article comparing different types on company structure.

First, let’s establish that a private company limited by shares is the way to go. If this is your first business, you can get straight to registering the company.

A quick overview on the requirements for foreigner to set up a business in Singapore:

- At least one local resident director who is a Singapore citizen, a Singapore permanent resident, or an EntrePass/Employment Pass/ Dependent’s Pass’s holder with LOC.

- At least one Shareholder

- S$1 paid-up capital

- A physical local address

- A company secretary

Types of Business Entities |

Purpose & Reasons for Choosing |

|---|---|

| Subsidiaries (Foreign Subsidiary Incorporation in Singapore) |

|

| Related companies |

|

| Representative office (Foreign Representative Office) |

|

| Branch (Foreign Branch Incorporation) |

|

| Re-domiciliation (Foreign company Re-domiciliation to Singapore) |

|

Work Visas for Foreign Business Owners

After you incorporate a business in Singapore, you will need to get the right visa to live in Singapore and run your business.

Employment Pass (EP) vs EntrePass

There will always be a debate over an EP or EntrePass for foreign business owners. We are advocates of the Employment Pass. Why?

1. Higher application success rate

A qualified individual for EP should have a tertiary or degree certification and a minimum monthly salary of S$4,500. This will be increased in September 2022 to S$5,000.

An EntrePass candidate is intended for serial entrepreneurs, high-calibre innovators or experienced investors whose business in Singapore that is venture-backed or owns innovative technologies. In comparison, the EntrePass is daunting.

2. EP is family friendly

If you’re bringing spouse or kids in, they can apply for dependent passes attached to your EP. The qualifying salary for the EP holder is S$6,000. However, if you’re on an EntrePass, you need a total annual business spending of S$100,000 and meet local employment requirements.

3. No specific requirement for renewal

The renewal of an EP is subjective by nature. The Ministry of Manpower (MOM) looks at the company’s need for the EP holder and their capabilities of engaging him/her for another period.

The EntrePass is has a progressive renewal criteria framework. By the 2nd year, you should plan to hire at least 3 full-time employees (FTE) or 1 local professional, manager or executive (PME). Your total annual business spending by then must be at least S$100,000.

EP vs Tech.Pass

The other new pass is the Tech.Pass. A new work pass initiated in 2021, the Tech Pass is available for top-notch foreign professionals and experts who are keen to launch businesses, head corporate teams, or become a lecturer in Singapore. Example: Top-notch e-commerce, AI, and cybersecurity foreign professionals and experts. While promising, it is still a new area and lacks case studies.

Paul Hype Page & Co. has 14 years of expertise in applying for EPs, we’ve accumulated a high success rate of 93%. Heavily attributed to our insights close working relations with clients. If your EP is important to you, call us for some planning.

Can foreigner be a director of a Singapore company?

Yes. A foreigner can be a director for a company in Singapore. This can be done by setting up a registered company in Singapore through an company registration service providers.

So If you are a foreigner planning to set up company in Singapore and want become director of the company, here’s what you should need to know:

- You must have at least one local director.

You can hire a local nominee director for 2 months and then once your company is incorporated, you can transfer the full ownership to you. In other words, you become a director in 2 months after your company is incorporated.

- You must have at least one local secretary

Next, In order for your company registration to be successful, you must appoint one local secretary who knows about the industry and all the filings requirements of your company.

Requirements for Foreigners to register a Company in Singapore

1. Work Pass

A foreigner needs an appropriate work pass or visa before legally setting up a company in Singapore.

- A foreigner needs an Employment Pass (EP) or an EntrePass should they wish to relocate and work in Singapore. They can now be the local director of the new business.

- If relocation to Singapore is not possible, a nominee resident director needs to be appointed. This is done to meet its compliance and statutory requirement.

- A foreigner can choose to have a subsidiary, a branch office, a re-domiciliation, or a representative office as an entry option when incorporating a Singapore company.

2. Company Name

The company name must meet a few basic requirements to receive quick approval during application. It must not contain vulgar or misleading words, and it cannot be linked to any national symbols or government organizations. It also cannot be similar to any existing corporate entities.

3. Director

There must be a minimum of 1 locally residing individual acting as a company director. Besides this. There are no limits on the number of local or foreign directors who can be appointed as long as the following conditions are met:

- The person is at least 18 years of age

- There are no bankruptcies on the person’s record

- The person has never been convicted of a crime on record

4. Shareholders

At least one shareholder is needed. This person can be a corporate entity, a resident, or a non-resident individual. 100% foreign ownership is allowed in Singapore and a company can have up to 50 shareholders.

5. Corporate Secretary

A qualified company secretary must be appointed within 6 months after the company is incorporated. This person needs to be a naturalized resident.

6. Paid-up Capital

A paid-up capital of at least SGD $1 is required when setting up a new private limited company. However, it is encouraged that a foreigner applying for an Employment Pass offer at least SGD $100,000 in paid-up capital. Not only does this make a strong first impression on any potential clients, but it is also a requirement for businesses working on government projects.

Challenges of Company Registration as a Foreigner

After you register a company business in Singapore, you will need a corporate bank account next. Not long ago, back in 2018, bank account openings used to be form-filling task and some administrative efforts. Now, there is strict enforcement of anti-money laundering (AML) frameworks and common reporting standards (CRS).

Some realistic problems you might face include:

1. Grants don’t apply to you

Local government grants generally have a requirement for 30% local shares in a company – one such example is the Market Readiness Assistance (MRA) grant that supports Singaporean companies in expanding overseas.

2. Other forms of financing are also difficult

Without an operational history, bank loans are difficult to get. If you’re founding a startup, the competition to obtain investments by venture capitalists are even more demanding.

3. Work visa renewal

Getting financing is difficult, but if your company is left dormant without revenue, it’s difficult to justify the need for you to stay in Singapore.

Most of the times, directors are not in Singapore to open their accounts. While most banks support remote account openings now, the trouble is in It results in banks wanting to see tax substance in a company.

Common indicators of tax substance include:

- Local staff in Singapore

- Physical office in Singapore

- Local sales or suppliers in Singapore

Things to Take Note After Setting Up a Company in Singapore for Foreigners

1. Business licenses

Doing business in Singapore is generally easy, most general consulting and service businesses don’t need a license. However, watch out for anything that might relate to specific industries like F&B, construction, finance, education, and more.

2. Open a Corporate bank account

After your Singapore company registration, the next step would be to open your corporate bank account.

Corporate bank account openings used to be a breeze back in 2018. 3 years and a pandemic later, most account openings can be done remotely but AML regulations are stricter than ever.

What used to be a form filling administrative task is now a presentation of whether your business has viable tax substance.

Your best-case scenario is if you are physically in Singapore for your account opening, or if you have an EP. If not, be ready to provide an executive summary of your business nexus in Singapore.

2. Office rental

Co-working spaces are the trend now. Most of them concentrated in the city area. We do have co-working spaces for rent – reach out to us if you ever need a working space.

3. Talent hiring

While hiring, act according to the Fair Consideration Framework of MOM which encourages local hiring before hiring foreigners.

4. Annual compliance

It’s relatively easy in Singapore to maintain your company. If your company doesn’t have specific taxes like goods and services tax (GST) or withholding tax (WHT), your compliance can be done just once a year. Make sure to consult with your accountants or company secretaries for this.

5. Living in Singapore

A very easily overlooked matter among the craze of setting up your business in Singapore as a foreigner. Some of the questions that you may have:

- What’s the plan with the accommodation?

- What’s the transportation like?

- Do you need to convert your driving license?

- Do you need to be vaccinated?

If you’re a foreigner relocating, you’ll have to think about living arrangements, tax implications, healthcare and so much more. You can either read more about the expat life in Singapore.

Conclusion

All things considered, if you’re looking to register your company in Singapore as a foreigner, having a local service provider heavily involved and supporting your operations would be a definite advantage.

For 14 years, Paul Hype Page & Co. has been coming up with creative solutions for our client’s EP applications, bank account opening, company secretary, and Filing Company Tax.

FAQs

Singapore has double tax agreements (DTA) with many countries in order to prevent companies and individuals from being taxed by both jurisdictions.

If your company operates out of a country that has a tax treaty with Singapore, the DTA may provide relief from double taxation. Do note that this depends on the particular service your company provides, as well as the specific provisions of the DTA in your country.

Yes. Shareholders can be a local or foreign, individual, or corporate entity. These shareholders can own 100% of the equity of the Singapore company.

All Singapore companies should have at least one director who is a Singapore Citizen or one who holds a Singapore permanent resident or an employment pass holder. However, a foreign director can be appointed alongside the local director.

Yes, foreigners can register a sole proprietorship in Singapore. Nonetheless, if they live outside of Singapore, they must appoint an authorized representative who is a legal resident in Singapore.

Among the types of business that you can form in Singapore are:

- Business Trust

- Foreign Branch

- Foreign Subsidiary

- Sole Proprietorship

- Partnership

No, a nominee director cannot be a foreigner. This is because a nominee director is appointed to fulfill the requirement of at least one local director of a Singapore company, thus, no foreigner is allowed.

The current regulations regarding the Employment Pass do not bar anyone from receiving one on the basis of nationality. Anyone who meets all of the relevant criteria may receive it. Therefore, any eligible person from any country may receive an Employment Pass.

Those who are interested in starting a Singapore business may select one of several business entities. Among these are the sole proprietorship, limited liability partnership, private limited company, and limited partnership. Foreigners have additional options such as the representative office, foreign branch, and foreign subsidiary.

Hi good evenin..

Hope you are doing well. Im ariff from Banglades. I would like to rice Start Business in Singapor. I wanna imports rice from India and sell it in Singapor. So how can i open up a company? Is it possible for me to do business there as a foreigner?

Can i have all the details for set up my business company in Singapor?

How much does cost to open a Business in Singapor?

Thank you

Arifur:

Thank you for contacting us.

We are happy to assist you with incorporation of private limited in Singapore. Please be informed that to incorporate a company in Singapore, at least one director must be a local director – Singapore Citizen, Singapore PR, or employment pass holder. The incorporation can be done online and not required to be physically present in Singapore.

The following are the packages we provided:

1. Incorporation with local (if you have your own local director);

2. Incorporation with employment pass (if you going to relocate to Singapore); and

3. Incorporation with nominee director (if you need local nominee director).

If you are going to relocate to Singapore, second option is the best for you whereby you can own the company and can manage it after your employment pass is approved.

To register and required for incorporation/to START your company registration, please find the link below.

https://my.tantoo.io/auth/signup

To apply and required for your employment pass/to START your employment pass, please find the link below.

https://services.tantoo.io/

Please contact us via Paul Hype Page to discuss further.

Thank you for your question.

Warm regards

Paul

Me a malaysian woman having a registered company in malaysia trading textiles,home appliances etc…i want to open a branch of my malaysian registered company in singapore…can i do it?? As woman can i get any supports from singapore govt.

Hi Janagi,

Yes, you can incorporate a company in Singapore provided you meet all the requirements. You may refer to the Ministry of Manpower (MOM)’s website for the needed requirements. Hope this help.

Best Regards,

Paul

Hello, I am a singapore citizen and my girlfriend is a malaysian working in Singapore for 3 years on work permit. She is thinking of quitting her job to start a small business together with me. We are thinking of starting small dessert/pastry shop together. Please advise on our options

Dear Neo,

The quickest option we would recommend would be our all-in-one Incorporation with Employment Pass package. Do drop us an email at paulhypepage@php-cpa.com.sg to set up an appointment to discuss the details, we look forward to hearing from you.

Best Regards,

Paul

Hi,I am British national in EP in Singapore. Getting married to an Indian national who works in Stock trading in India. We plan to apply for depend pass through my company. But wondering about his options of working in Singapore.he plans to continue his trading in Indian market (as his clients are based there). Can he continue to work remotely without any legal issues? What steps will we need to make so that he can start trading in Singapore trading market also? We would like to ensure all legal steps and tax duties are fulfilled in India and Singapore. Thanks, kan

Dear KayDee,

Your husband can still work remotely for the India operation part. As for Singapore, he needs to set up a company and obtain a work pass under the company. With the company and the work pass, he will then need to go ahead to register as a securities trading company. Hope this helps.

Best Regards,

Paul

Thanks Paul, much appreciated for a quick revert. In terms of setting up a company and paperwork associated, do you provide any services? And what is the b st way to contact please? I assume once that is done he will need to different visa than a Dependent Pass?

Also in terms of his remote working, assume any tax implications need to be fulfilled on the basis of Indian Tax structure? Are there any implications of Double tax at all until the time he sets up and starts his work in Singapore?

Many thanks

Hi,

I am Singapore PR, can I set up a company with another partner who is come from Malaysia?

Hope to hear you soon.

Thank you.

Dear Gina,

Yes, you can. Should you need further advise on incorporation and company setup in Singapore, do drop us an email at paulhypepage@php-cpa.com.sg to set up an appointment. We have a branch office in Malaysia as well.

Best Regards,

Paul

Hello sir,

Good day.Hope you are fine.I’m Ali from Pakistan.

Sir i have a question is it right singapore don’t give work permit for Pakistani People?

If it is right then how you will provide me employment pass with my company registration.

Hope you will answer soon.

Best Regards,

Ali

Hello sir,

Good day.Hope you are fine.I’m Ali from Pakistan.

Sir i want to tell you i have a company of medical instruments want to open my company in singapore.But i have no big company.So can you help me to register my company there.And can i also do there any job during company registration.

And please tell me all expenses.

And i’m also coming in singapore so can we meet in singapore.

Hope you will answer soon.

Best Regards,

Ali

Dear Ali,

Singapore is one of the best places for a startup company of any size. Our all-in-one Incorporation with Employment Pass would be the ideal solution to what you may be looking for. Do drop us an email at paulhypepage@php-cpa.com.sg for more details and charges. We will be better able to advise you once we know more about your company.

We look forward to meeting and working with you.

Best Regards,

Paul

Thank you very much for your kind reply.

And i have been sent you email.

Please check and tell me.

Thanks

Hi I’m having a garment showroom in India and I would like to start the same in Singapore. My friend is a DP holder in Singapore. What are the formalities to be followed for setting up a retail shop in Singapore?

Hi Iysha,

You can certainly set up your business in Singapore with our support, especially with our all-in-one Incorporation with Employment Pass package. Our helpful sales personnel will email you with the details.

Best Regards,

Paul

Dear paul,

I am from Indonesia and i would start an IT company in SG. could you please give me the requirement for it?

the minimum capital, the law, the taxes and also could you give me the cost for your service until my company can running.

thanks

Dear Gerson,

We recommend that you consider our all-in-one Incorporation with Employment Pass package to help you get started. We would love to hear more about your company so we can better advise you on what to do. Do drop us an email at paulhypepage@php-cpa.com.sg for more details and charges.

Cheers,

Paul

Hi, i am shanil from india. I would like to start a corporate training center in Singapore. Currently we have offices in india and UAE. Is it possible to provide necessary informations? And I am a UAE Resident Visa (Invester Visa) Holder. I just need to set up 3 staffs working office (minimal requirements) and bank account and licenses. Expecting ur reply

Dear Shanil,

All we need is your passport and proof of address, fill up our incorporation form and we will be able to set up your company within 2 working days. We would suggest our all-in-one Incorporation with Employment Pass package. More details about your company would be helpful, as we would be better able to advise from there.

Do drop us an email at paulhypepage@php-cpa.com.sg and let’s talk more.

Cheers,

Paul

Hi , Paul ,

I send mail to ur email I’d , kindly reply me asap, i given my contact number too,if possible then please contact me,I am waiting for reply with all details.thanks

Hi,

I would like to set up a small business in Singapore.Please advise me what is the minimum capital required and also procedures

For the same. I am from Philippines.. Thanks

Dear Abel,

Thank you for getting in touch. You’ve made the right choice choosing Singapore as a business destination, we are one of the easiest countries in the world to do business. The minimum capital to start a company in Singapore would be SGD$1. To proceed to the next step, we would need more details regarding the nature of your business to offer more specific advise.

Do drop us an email at paulhypepage@php-cpa.com.sg . Have a great day ahead.

Best Regards,

Paul

Hi,this is Amit from India,actually I want to start a fabrications company in Singapore,I want to get all details about this,including the business place ,bcuz of that m kming to Singapore ,n which Visa will work for that,?or wat is the condition to get PR,N HOW MANY DAYS WILL TAKE A TIME FOR PROCESSING? PLEASE GIVE ME ALL THE DETAILS,,

Dear Amit,

Our Incorporation with Employement Pass package is the best solution for entrepreneurs looking to open their first venture in Singapore. It will be recommended to apply for Employment pass first and operate your business in Singapore for a while before you apply for PR (PR process may take from 6 months to 2 years depending on individual criteria)

Do drop us an email at paulhypepage@php-cpa.com.sg if you need further assistance on securing Employment Passes. Have a great day ahead.

Cheers,

Paul

Dear Sir/Madam,

I am from pakistan, I want to start computer or grosery shop in singapor. Please tell me how can i get visa and how much investment i needed for it ???and how much time process will take

Dear Umar,

Our Incorporation with Employment Pass all-in-one package is the answer to help you get started in Singapore. My colleague will drop you an email shortly with more details and charges. Hope to hear from you soon!

Cheers,

Paul

l, will like to set up a small business in Singapore. i am from Ghana. i can travel to Singapore without attaining a visa but not work visa. can you please advice me as to how to get the work visa and incorporation. please tell me how much will i spend in getting all the documents done for me.

Again, let me know what will be required. Thanks.

Dear Isaac,

Thank you for getting in touch. May we recommend our Incorporation with Employment Pass all in one package if you’re keen on opening a company?

My colleague will drop you an email with more information on the details and charges shortly. We hope to hear from you soon!

Best Regards,

Paul

Dear Sir/Madam,

Currently I am a student in Singapore and I would like to open the company. Is it possible for in my situation?

Thanks,

Alexander.

Dear Alexander,

Perhaps you could tell us more about the kind of company you wish to setup? We would be able to advise you better once we have more details.

Do drop us an email at paulhypepage@php-cpa.com.sg for more details and charges. Hope to hear from you soon.

Cheers,

Paul

Hello,

I would like to know the process and set up cost of a consultation company in singapore.

Yours Sincerely,

Abdulla

Dear Abdulla,

We would like to have a consultation session with you to better discuss your options and how we can help you set up your company. May I recommend our Incorporation with Employment Pass solution? I believe that would be the best approach for your business needs. My colleague will email you shortly with more details.

Cheers,

Paul

Dear Sir/Madam

Please provide me information regarding business of mechanical garage in singapore I like to open mechanical garage business in Singapore.

Thank You,

Dear Ahmad,

We would recommend you consider our incorporation solution package that allows you to setup your own business and apply for employment pass. Do drop us an email at paulhypepage@php-cpa.com.sg for more details and charges.

Kind Regards,

Paul

Hi Paul,

I am from India, and i would like to setup a Restaurant in Singapore. Initially i was working in a Singapore bank, but now because of the project completion and i have moved back to India. My EP stands expired as of now.

Request you to please help me with the paperwork for restaurant business , and the investment required for this venture.

Also what sort of VISA i need to apply for this ?

Regards,

Birendra

Dear Birendra,

We will be able to assist you from incorporation to applying the right work visa and permits. You may also refer to Starting a Singapore Restaurant for more information.

Do drop us an email at paulhypepage@php-cpa.com.sg for more details and charges.

Kind Regards,

Paul

Hi Paul

I was wondering if you could help me with setting up a business in Singapore. I am planning to put up a fastfood chain franchise in Singapore. I would like to know the step by step process. I am a Filipino Citizen but I am a permanent resident of Australia. Also, I would like to know what type of visa should I be applying for and is it troublesome to apply for one? How long does it usually take to process all the required documents? Do I need to provide a bank statement when applying?

Thanks so much

Regards,

Kristine

Hi Kristine,

You can consider our incorporation solution package which allows you to setup your own business and apply for an employment pass. Paul Hype Page & Co. has the expertise you need from years of helping foreign entrepreneurs start their own businesses.

We would love to hear more about your company so we can better advise you on what to do. Do drop us an email at paulhypepage@php-cpa.com.sg for more details and charges.

Cheers

Paul

Dear Sir/Madam,

I would like to register a company at Singapore for opening my online shop at Lazada. I don’t need the working visa. The only thing i need is the local bank account. Can you kindly advise what’s the basic requirements?

Many thanks

Kindregards

Dear Kevin,

Opening a bank account in Singapore is a fairly straightforward process. At Paul Hype Page, we can assist you from incorporating a company to arranging the banker for you for the account opening. We would love to hear about your goals and needs for the account, do drop us an email at paulhypepage@php-cpa.com.sg for further consultation and charges.

Cheers,

Paul

My partner is currently holding a work permit and working in singapore.

Can i apply EP for him and set up a new company (teaching music).

Hi Yuki,

If your partner met the criteria of EP, then yes you can consider setting up your own company and apply EP for him.

We will be able to assist you from incorporation to employment pass application, pls drop us a note via contact us and my corporate specialist will send you the relevant details.

Cheers

Paul

hello sir,

We are currently holding a business of a General merchandise business here in PH, existed almost 5 years, from our frequent visit to Singapore, my husband and I are interested in putting up small shop in Singapore and and try a living there because so far it is our well loved country and wished to be there in the future.Please send me anything that that I can send to process our inquiry and the steps in making this possible. All the best and thanks!

Rica

Dear Rica,

An incorporation of a Private Limited company in Singapore with Employment pass application will be suitable for you.

Our Corporate Specialist will drop you an email with more details

Paul

Hello, I am from India. We have a garment manufacturing unit in India now we want to open a branch office and extend our business in Singapore. Could you please tell us the procedure and the minimum capital we require?

Dear Cheena,

We will need to understand more about your business operation so we can recommend the right business setup for your company. The most recommended business setup will be Private Limited where you will need as little as SGD2 as capital.

Paul

Hi Paul, thanks for your reply. Let me tell you more about our business. We have a garment company here in India, and we manufactures the ready made garments for domestic and export. Now we want to open a outlet or showroom in Singapore where we can sell our clothes. So could you please guide us regarding this. Thanks in advance.

Dear Cheena,

My corporate specialist will drop you an email and follow up with you from there. If you dont get any email, pls drop us a note on CONTACT US page.

Thank you

Paul

Hello Paul

I have not received any mail yet

Thanks

Sir,

Greetings!!!..

we have our own government certified organic estate in india (10 hectares) in hill station 4500ft.our farm produces are coffee,pepper,jack fruit,avacado ,turmeric.we want sell these produce in singapore.

kindly guide us to venture our business,

yours truly

pon dhandapani

Dear Pon,

Apart from setting up your company, you may also need to find out more about the import business licenses you may need. Our corporate specialist will contact you with more details.

Paul

hi

i am bangladeshi .i got one company in singapore.this is food business.my income tax diclare 42000 sin.long time not stay in singapore.but business on.now i want to stay singapore..plz advice me how to get ep..and how much cost.

my company name puncak best noodles halal muslim food.far east plaza #05-9495

Dear Hazi,

Our EP application service is charged at SGD800. To find out more about your eligibility an EP pass, you can do an online SAT test – https://services.mom.gov.sg/sat/satservlet .

My colleague will also drop you an email about the Criteria of Employment pass for your refers.

Cheers

Paul

Hi !

We are currently holding a Pass Holder here in Singapore and wish to open a small Filipino Store Business ,

Is there any qualification and what are the requirements that we need to fill up in, in order to open-u and operate.

Thanks,

Jnet

Dear Jennette,

If you are an employment pass holder and wish to incorporate a Private Limited company in Singapore, we can assist you in the setting up and application process. All you need to do is to fill up our incorporation form with your ideal company name and our corporate specialist will be able to contact you with more information.

Paul

Hello sir, I’m a British citizen and want to setup a business in Singapore. mainly a trading business, take the order from my buyers in other Asian country (mostly garments machinery) and supply their machinerys and payment through proper banking channel. I want to setup in Singapore as income tax/ corporation tax is too high in UK. can you give some more details please? can I open business as a British citizen or I have to join with someone living in Singapore? do I need a visa for that? due to my business nature, I physically don#t need to stay in Singapore for long time, if needed I can go once in a month or when I got the order. please suggest.

Thanks/masud

Dear Masud,

Setting up a business in Singapore is easy and fast with the right structure. You can start by setting up your company (Pte Ltd) in Singapore.

We will drop you an email with more information of our Incorporation with Nominee director solution for your refers.

Cheers

Paul

Hi!

I’m a well experienced engineering professional living outside Singapore. I’m looking forward to start proprietorship business in equipment and spare parts trading in Singapore, with least capital. Pls. guide on requirements, prior to entry to Singapore and as well, kindly advice me as to how to apply for an entry visa for self and family dependents (wife and children, aged below 21 yrs).

Awaiting your reply.

Thanks & regards,

NK

Dear NK,

You can start by starting your company (Pte Ltd) in Singapore. Once you are able to obtain an Employment pass (with min salary above $5000 so you can apply for Dependent pass for your family), you can then apply DP for your family.

We will drop you an email with more information of our Incorporation with Employment solution for your better understanding.

Cheers

Paul

Sir, I would like to export banana and banana products like chips to singapore, please help me to know the requirements, expenses and so on.

Dear Akhil,

You can start by incorporating a company (Pte Ltd) in Singapore and then apply import permit for food product coming into Singapore. We will be able to assist you in the incorporation and work pass / or nominee director solution (if you are not relocating to Singapore). My colleague will drop you an email with more details and cost for your refers

Cheers

Paul

Dear sir,

I am from India. I got IE code and i am interested to start a business in singapore. we are the manufacturers of amla juice, health mix and food products. And also trader of agricultural products. can you pleas guide me the opportunities to start an business in singapore. And kindly tell me the cost of expenditure to start a business.

Thank you

Regards,

Madhan

Dear Madhan,

Thank you for contacting us.

In order to start business in Singapore as a foreigner, you will need to set up a private limited company, followed by applying for work permit (employment pass). The pricing for our services starts from $3,155, which is also presented on our website as well. https://www.paulhypepage.com/our-fees/#Incorporation-with-Employment-Pass-Package

To speak to our representative, please give us a call at 6221-4711 or simply drop us an email. We will send you an intro email for your information anyways. Have a great one!

Best Regards,

Paul

Hello,

I am currently employed in Singapore on an EP, however I would like to start my own separate business designing, manufacturing and selling goods.

Is it possible for me to set up a new business on my existing EP?

Thanks

Adam

Dear Adam,

You would need to apply for a new EP after setting up your own company in Singapore. Please contact us at 6221-4711 if you would like to speak with our representative for more information.

Thanks,

Paul

Hi sir/madam

I am from Malaysia and just visited Singapore to look for business opportunities. I much interested to start 24 hours convenience shop in Singapore. What the possibility I can own business as a foreigner? Really need your advise.

Thank you

Dear Sumar,

We have many Malaysia clients whom are successful entrepreneur in Singapore with employment pass. We will need more information about your business setup and your work experience in-order to assist you better.

My colleague will drop you an email with more details on our services for incorporation and work visa.

Paul

Hello,

I want to start an import export trading company in Singapore. I am a citizen of India. I am in Singapore currently till Tuesday. I would be willing to come down and meet in person if I can get an appointment to understand the whole procedure and costs involved and everything. Thank you :)

Dear Anjali,

Thank you for contacting us.

We understand that you would like to start an import and export trading company in Singapore. As you are a citizen of India, you would need to apply for an employment pass if you would like to relocate to Singapore. Our representative will be in touch with you shortly for more information. Look forward to discussing together from there.

Cheers,

Paul

Hello,

Would like to know that operate a ecom multi-retailer base in Singapore . Should I apply license to operate this website as a foreign . If need to apply what qualifications need and capital need to prepare.

Regards

Wei Yew

Dear Wei Yew,

Thank you for contacting Paul Hype Page.

First the company must be registered under ACRA in order to operate any business in Singapore and the website you’ve mentioned. A copy of your passport (or IC card if you are Singaporean) and proof of residential address will be needed to set up a company. There is no minimum paid up capital required to start.

Please contact us for more information about incorporation. We will be happy to assist you.

Cheers,

Paul

hello sir

I would like to start a cashew trading company in singapore. I need to know how to register the company and what are the documents need to submit ? registration fees amount ,in which visa i need to come if i will come for business registration

Hi Gowtham,

Thanks for your interest.

In order to register a company in Singapore, you would be required to submit a copy of your passport and proof of residential address. You would need to apply for an employment pass which will authorize you to work and live legally in Singapore. Our pricing for incorporation and employment pass is $3,155. We will send you more information in detail to your email. From there, we can discuss further about the further process.

Cheers!

Paul

Dear Sir !

I like to setup a retail business in singapore can I get more details on the processes minimum requirements and cost of setting up a company in Singapore ? I also need more details on work passes ,setting up of bank accounts and registration of company .

Thank you

Best regards !

Hi Paul,

I am from India and working on EP since 2007 in a local bank (My employer will allow me to take week-end work mentioned below so far I get the content approved by them for Non-Disclosure related items). My PR got rejected already 3 times. Now, I want to do following as part-time over the week-end business, do I need to register a company or get another visa? How can you help me? What are your consulting charges?

1. Become book Author and publish my books with US/local publisher

2. Publish self-learning online trainings on learning portals like UDEMY

3. Provide virtual class-room training over the week-end or after office hours

4. Publish Mobile gaming paid apps (non gabling/casino) on Apple store

5. Build self-running online portals related to IT tools (will be supported initially from India)

Thanks

Hi Kumar,

Thanks for your inquires.

As your current EP is strictly tied to one particular company only, it is not possible to obtain another working pass unless you resign from the bank you are working for now. However, it is still possible to set up a company under a nominee director and if you have any of your family members who can play a role of foreign director, this is also an option for your case.

Our incorporation services charges start from $1,955 as you can see from our link below.

https://www.paulhypepage.com/our-fees/#Company-Incorporation-Services

Should you have any other questions, please don’t hesitate to contact us.

Cheers,

Kumar

I need starting tailaring shop in singapor

Hi Ibrahim,

We can help you to start your own tailaring shop in Singapore. Our representative will be in touch with you shortly.

Thank you,

Paul

Hi,

I am a DP holder working on LoC. I wish to start a consulting business. Can I do this along with my job by incorporating a company parallels?

Hi JM,

You will need to apply for another LoC to work for a new consulting company as a director. For more details, our representative will be in touch with you shortly.

Best Regards,

Paul

I like to open a company in Singapore, can u help me…and Wat is the procedures, pls reply..

Hi Sminto,

We can definitely help you setting up your own company in Singapore. We will drop you an email shortly.

Thanks!

Paul

Hi,

I am from,Ihave experience in online commodity trading,i wnat to do in Singapore market. Please provide the details.

Hi Shiva,

If you are looking into setting up a company in Singapore for online commodity trading industry, we can help you at a cost of $3,155. This includes our incorporation. employment pass, etc.

For more information, please drop us an email with questions you may have.

Thank you,

Paul

Hello Paul, i am selling natural Malaysia honey. Want to get new market in Singapore. Can register as sole prop to bring in from Msia and sell?

Dear Ismail,

As a foreigner, you will need to appoint at least one locally resident representative. One of other options is that you can set up your own company and apply for employment pass.

Paul

Hi Paul,

I have a Law degree from India and I wish to set up a Company in Singapore and operate a restaurant or take away food outlets there with my Indian partner and a local Singaporean director. What is the minimum capital requirement? Do my partner and me need a Entrepass to do business, it seems quite difficult to get because of the eligibility criteria? What other visa oprions are there? Please advise. Best regards Sumit.

Dear Sumit,

You may also look into Employment Pass. The eligibility for this pass is to have a bachelor’s degree with no minimum capital requirement. Our representative will be in touch with you for more information.

Paul

Hi paul, i want to know the person should be educated for do any kind of business in singapore?

Aur need only capital?

Rgrds

Danish

Dear Danish,

You would need at least a bachelor’s degree to apply for EP (employment pass) which will give rights to do business in Singapore.

Otherwise, you can set up a business with local nominee director which we can provide. For details, our representative will contact you shortly.

Thank you,

Paul

Hi

Im from India. I worked in Singapore more than one year as an EP from October 2013 to Feb 2015.

Now I want to start organic vegetable shop in Singapore. I would like to know the minimum required investment to start

Dear Kumar,

There are no requirements for minimum paid-up capital when incorporating a private limited.

There are many advantages for a Pte Ltd company setup especially for foreign investors. Its protects your personal assets and also provides tax benefits by Singapore. Additionally, A Pte Ltd company also allows shareholders and foreign directors to apply for employment pass.

Paul

Dear Sir

I am from Indonesia and I plan to open a Fitness supplements store in Singapore. Currently im doing this business too in Indonesia, I plan to sell in Singapore and also export it to my Indonesian customer, What are the clearances, application do I need? I don’t have workers, I am a sole proprietor. want to do doing a online business in Singapore.

and how about the taxes in Singapore if i exported to Indonesia ?

Hope you can guide me

Thank you and have a great day!

Dear Anthony,

Yes we have just the incorporation package for you. My Corporate specialist will email you with more details.

Cheers

Paul

I want start business in singapore.

Dear Sirs!

I am from Russia and I am going to open a chain of nail bars in Singapore. Which tax should I pay if my employees will be also foreigners? Can you help me with legal procedures (for manicure spot) and with all organization?

Best regards!

Olga

Dear Olga,

It will be hassle free for you if you engage PHP incorporation package so we can assist you from registration your company to setup and work visa application as well as accounting and payroll. This also allow us to setup the right business module from the beginning to ensure smooth transaction for work pass and account thereafter.

Please call our corporate specialist for more details today.

Paul

hi

im from sri lanka i’d like start business in singapore,(export & import). but how much is cost for registration (including nominee directer)?

Thank you

Dear Shashika,

You can go for our Incorporation package with Nominee director for a year at SGD 5,755 which includes Incorporation, Acra fee, Company Secretary services, registered office address and nominee director for a year.

Paul

Hi,

I’m from Philippines and I have a small business here where I sell skin care made in the Philippines and some cosmetics that I import from other countries to sell. I would like to also sell in Singapore so I am looking for a guideline on how I can make it possible. What are the clearances, application do I need? I don’t have workers, I am a sole proprietor.

Hope you can guide me accordingly.

Thank you and have a great day!

Regards,

Angel

Dear Angel,

You can consider setting up a Pte Ltd company in Singapore. That will also allow you to apply for employment pass (work pass) if needed.

My corporate specialist will email you with more details.

cheers

Paul

Hi,

I am from India, want to setup a Trading Business for Housekeeping Equipments & Hygiene Products in Singapore.

Currently I am having a Proprietorship Business for same products in Noida (Uttar Pradesh), India.

What are the procedure, documents, Time frame & cost involvement to start a business in Singapore?

Regards,

Vaibhav Jain

Dear Vaibhav,

Timeline to Set Up a Singapore Private Limited Company

•Our incorporation team, upon receipt of all incorporation documents from the client, visits the web portal BizFile+ to search the availability of the name for the proposed company. Once it is approved from ACRA and we will reserves it for you.

*Please note that ACRA wants to maintain the uniqueness in the names of the companies under its jurisdiction. If the company name is improper, confusing, an imitation, or if it is blacklisted, ACRA rejects it.

•Our Corporate Specialist will then submits the application for company registration to the Company Registrar with duly signed documents. The registrar may notify, the acceptance or the rejection of the application online, in 1 hour.

•Once the registration is successful, ACRA sends an email giving details of incorporation like Company Number, date of issuance, and etc. The email serves as the Certificate of Incorporation in Singapore.

After a successful company incorporation in Singapore, PHP also assists our clients in acquiring the relevant work visa, the right business licenses and permits, opening a corporate bank account in a local bank, and ordering Company Seal and stamps.

You may setup a company in Singapore within 24 hrs. (Provided all documents are in order).

Do give us a call today to start your Company Incorporation!

Paul

I’m a PR who wish to set up business with a foreigner (msian).. Both of us will be the directors of company yet we do not have $50k to apply for entry pass. Kindly advise if we could start a business in singapore tq!

Dear Cloudy,

Employment pass maybe a better option for your partner case.

To successfully register a Singapore company, the entrepreneurs should have fulfilled the following requirements:

•At least one shareholder

•At least one local director

•At least one company secretary

•Minimum paid-up capital of S$1. (However we do recommend to provide reasonable start up capital that is relevant to your business)

•Registered company name

•Local registered business address for your company

•Memorandum & Articles of Association

Do book an appointment with our Incorporation team to start your company today!

Cheers

Paul

Hi Sir/Madam

Im malaysian, i wish to open a bakery shop in singapore with a Singaporean friend of mine. I would to know what should i do or need in order to open a bakery shop where this bakery shop only need 2 persons in charge. Thank you

Jason

Der Jason,

My colleague will email you with more details. Once you are ready, we will be able to assist you in your incorporation and setup.

Looking forward

Paul

Good day sir/madam,

Im Perry a filipino citizen,im engaged in bamboo handicraft business here in the philippines and im planning to set up business in your country. My question is are we allowed(foreigner)to put up bamboo handicraft and furniture business in singapore?and what are the necessary requirements please advise and thank you and God bless.

Perry.

Dear Perry,

We will need to understand the model of your business to advise the company setup and incorporation in Singapore. Do give us a call.

Paul