Foreigners Own Over 40% of Registered Companies

Singapore Company Registration is a popular choice among global entrepreneurs due to the nation’s strong business appeal. As a global business hub, Singapore attracts more than 40% of new companies with foreign ownership.

The country’s business-friendly policies, strong legal system, and strategic location make it ideal for international investors. Moreover, its low corporate tax rates and straightforward incorporation process simplify market entry.

In addition, foreign investors benefit from a highly skilled local workforce, making it easier to establish and expand their operations in Singapore.

Related Read: Current SME Trends and Growth Outlook 2024

What Does This Mean for Foreign Entrepreneurs?

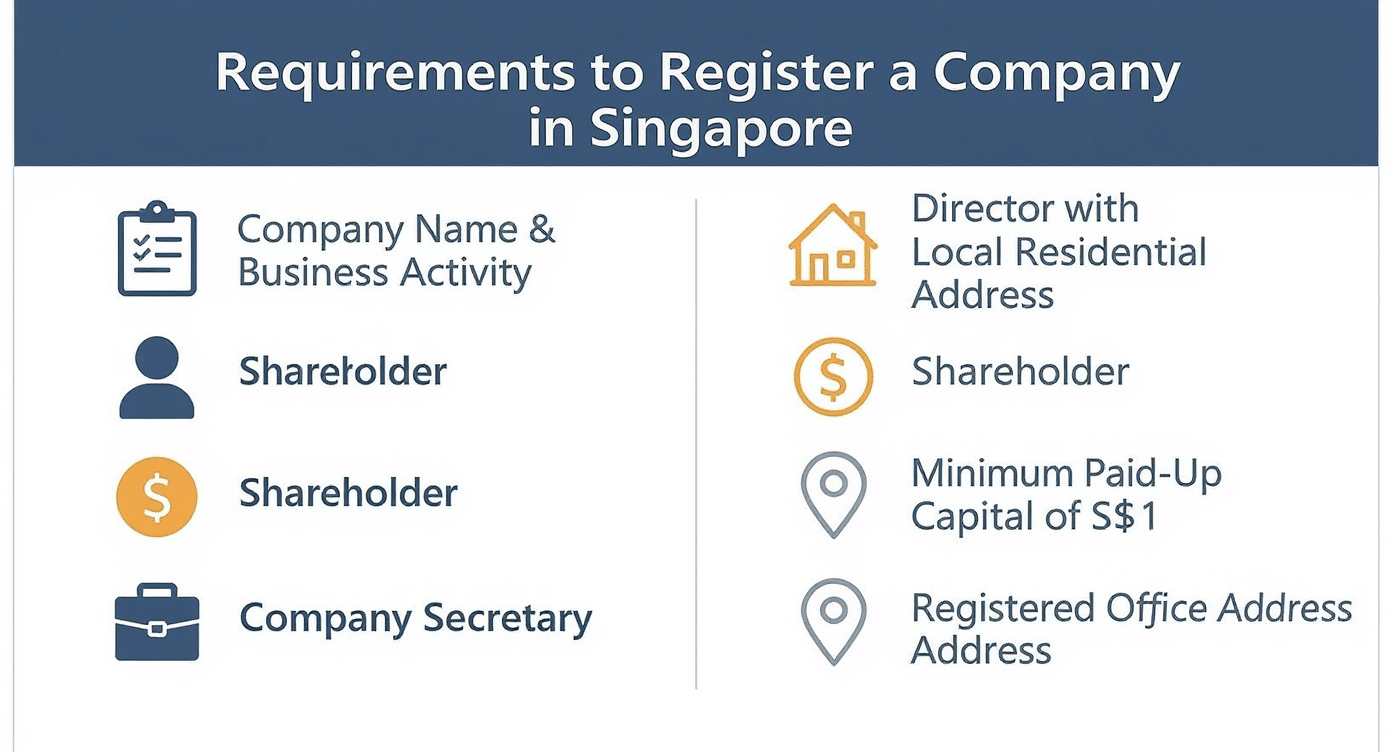

Understanding Singapore Company Registration Requirements

The requirements for registering a company in Singapore are straightforward.

Check Your Company Name Availability Using Our Free Tool!

Please enter the full name you would like to use for your company — for example, ‘Singapore Airlines’ — and click on ‘Search Name’ below.

What is the Process to Register a Company in Singapore?

Here is our step-by-step guide on Singapore company registration, you can check your company name availability here!

Who Can Register a Business in Singapore?

Singapore’s business-friendly policies make it easy for both locals and foreigners to incorporate a company. Citizens and Permanent Residents can register with no additional requirements.

Foreign entrepreneurs must appoint at least one local director but can still retain 100% ownership. Those expanding into Singapore may choose to set up a Subsidiary, Branch Office, or Representative Office—each offering varying levels of independence.

If you don’t have a local director, our Nominee Director Services can help meet regulatory needs while allowing you to maintain full control. This ensures compliance and provides a straightforward path to establish a business in Singapore.

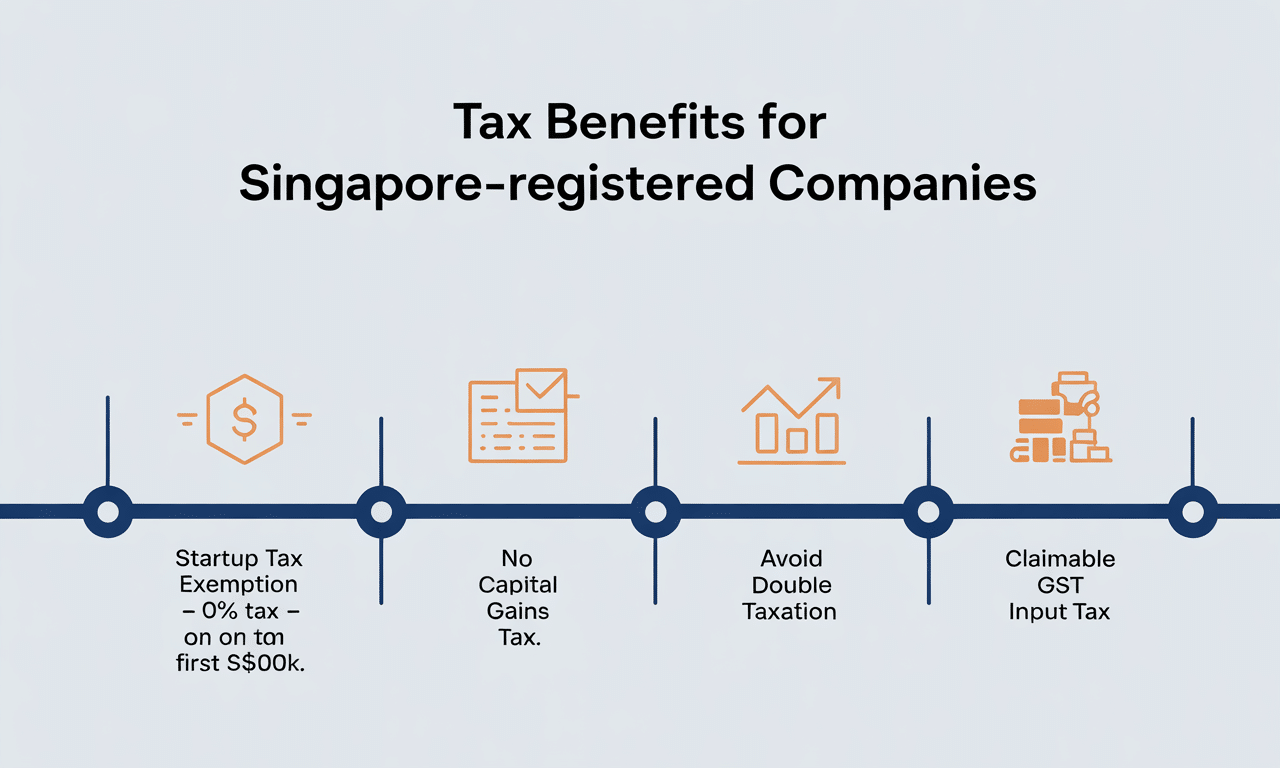

Tax Benefits for Singapore-Registered Companies

New startups enjoy exemptions—no tax on the first SGD 100,000 of taxable income for the first three years, plus 50% exemption on the next SGD 190,000. This reduces early-stage tax burdens significantly.

Beyond low tax rates, there’s no capital gains tax. Profits from investments, asset sales, or shares are entirely tax-free.

Singapore also has Double Taxation Agreements with over 80 countries, helping businesses avoid being taxed twice on international income.

Companies registered for GST can claim input tax on expenses, improving cash flow. All these factors make Singapore Company Registration a smart move for sustainable growth

Requirements to Register your Company in Singapore as a Foreigner?

Our Singapore Company Incorporation Services

With extensive expertise in business registration across Singapore, Malaysia, Indonesia, and Hong Kong, we specialize in incorporating private limited companies (Pte Ltd) in Singapore. Our in-depth knowledge of Singapore’s incorporation process and proven success in facilitating seamless registrations make us the trusted partner for businesses. Let us guide you through a smooth and efficient journey, ensuring your company is set up quickly and without hassle.

Common Types of Business Structures in Singapore

-

Private Limited Company (Pte Ltd)

The most common and recommended structure. Ideal for entrepreneurs and SMEs looking for scalability, limited liability, and credibility with banks and investors. -

Limited Partnership (LP)

Suited for business collaborations where one or more partners manage operations and others act as investors without active involvement. -

Limited Liability Partnership (LLP)

A hybrid model offering flexibility in management while protecting partners from personal liability. -

Sole Proprietorship

Best for small, low-risk businesses or freelancers. Easiest to set up but comes with unlimited liability.

Each structure has its pros and cons. It’s important to evaluate them based on your business type, growth plans, and regulatory responsibilities.

What is the timeline to incorporate in Singapore?

The typical timeline for setting up a company in Singapore is 5 to 7 working days. However, this can vary based on how efficiently the company secretary works with shareholders and directors.

A key factor is how quickly each party submits their required documents—proof of identity and residential address—to the secretary for verification.

The faster the documents are provided, the quicker the registration can proceed. Some companies are incorporated within hours, while others take longer due to delays in paperwork.

For shareholders and directors, timely submission is essential. It speeds up the Singapore company registration process and ensures a smooth experience.

Post-Incorporation Compliance in Singapore

After successfully registering your company in Singapore, you must follow through with several important post-incorporation steps. These include setting up a corporate business profile, opening a corporate bank account, securing the required licenses and permits, and fulfilling your annual filing obligations to remain compliant with local regulations.

Opening a Corporate Bank Account in Singapore

Establishing a corporate bank account is one of the first operational steps for any newly incorporated company in Singapore. The process usually involves confirming your business structure, submitting the relevant incorporation documents, providing proof of identity and address, and completing the bank’s application forms.

Singaporean banks may also conduct due diligence checks, particularly for foreign-owned entities, to meet financial compliance standards set by MAS and ACRA.

Obtaining Business Licenses and Permits

Depending on your business activities, specific licenses and permits may be required before you can legally operate in Singapore. For example, businesses in the food and beverage, financial, education, or health sectors must comply with additional licensing regulations.

Failure to obtain these approvals may lead to penalties, exclusion from certain industry associations, or even business suspension. Agencies such as ACRA, MAS, and SFA oversee various sectoral compliance requirements.

International Trademark and IP Protection

Registering your intellectual property, especially your brand trademark, is a vital step in protecting your company’s identity. International trademark registration safeguards your branding and enhances your market presence. This is particularly important if you’re planning to scale into ASEAN or other global markets.

Our 2 Decades of Proven Expertise Will Guide Your Business

With over 20 years of experience across Singapore, Malaysia, Indonesia, and Hong Kong, we’ve successfully incorporated more than 2,000 companies in various jurisdictions.

In Singapore, our high success rate in securing work passes and handling complex regulations reflects our commitment to client success

As trusted advisors, we use strategic networks and market insights to streamline the Singapore company registration process—helping businesses build a strong foundation in a competitive environment.

Singapore Company Registration Guides

Supplement your existing knowledge with additional insightful readings that we’ve crafted based on our 20 years of experience.