Outline

- What is a Singapore Subsidiary Company?

- Is a Subsidiary the Same as a Private Limited Company?

- Advantages of Setting Up a Subsidiary in Singapore

- Know Your Customer (KYC) Processes for Singapore Subsidiaries

- KYC Requirements by Corporate Service Providers (CSPs)

- Filing Annual Returns of a Foreign Subsidiary in Singapore

- ACRA Annual Compliance

- Singapore Tax Rates

- How to Register a Singapore Subsidiary Company?

- Frequent Challenges When Registering a Subsidiary

- FAQs

Setting up a subsidiary company in Singapore is one of the most strategic and accessible ways for foreign companies to enter the Asian market. As a global business hub with a strong regulatory framework, pro-investment legislation, and competitive tax incentives, Singapore is home to over 37,000 international companies that have established their regional headquarters here. This guide outlines what a subsidiary is, how to register one, the benefits of this structure, and the challenges companies often face.

What is a Singapore Subsidiary Company?

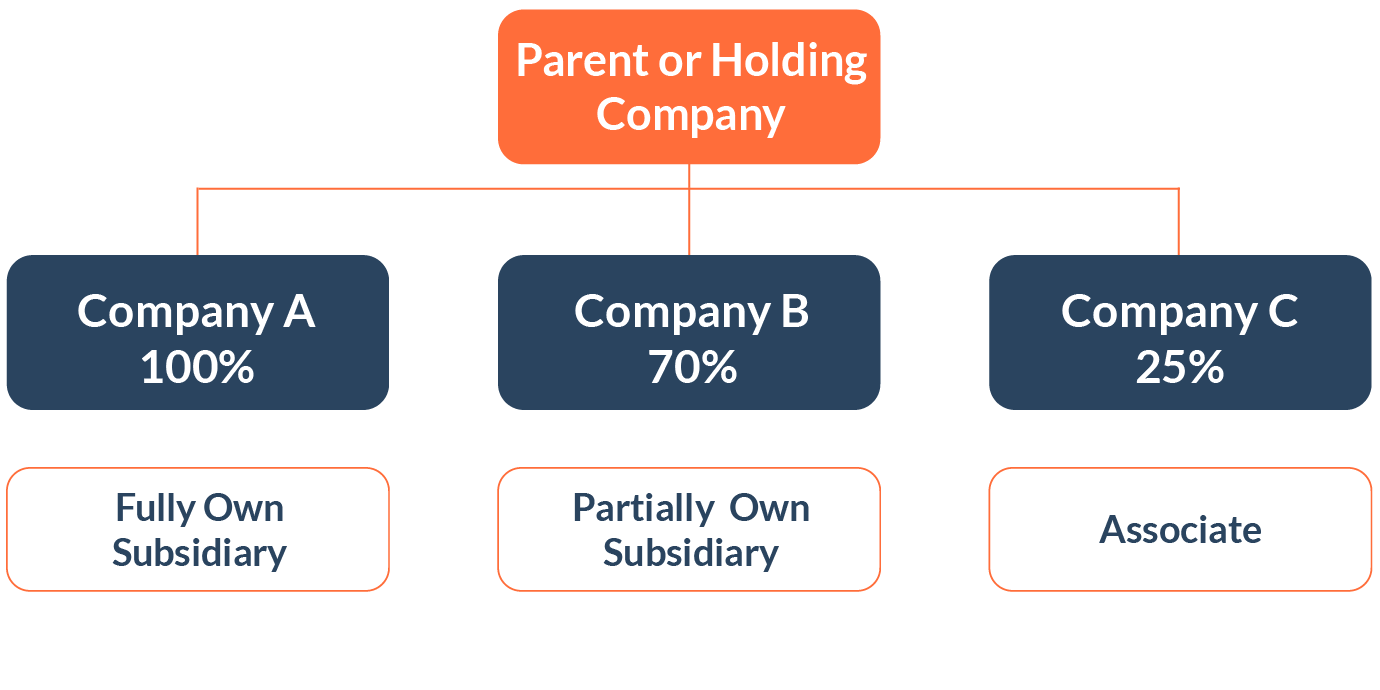

A subsidiary is a private limited company that is either wholly or majority-owned by another company (the parent or holding company). This structure allows the parent company to retain control while limiting its liability. A wholly owned subsidiary is one where the parent company holds 100% of the shares. In Singapore, subsidiaries are considered separate legal entities and are treated as local tax residents, giving them access to the country’s extensive tax treaties and exemptions.

Shares Ownership of a Subsidiary

A foreign parent must own at least 50% of a company to classify it as a subsidiary. It also means that the minimum parent share ownership is between 50% to 99% only. An individual or any corporate legal entity can hold the remaining 1% to 50% of the shares. If the parent owns 100% of the shares of their subsidiary, it constitutes a wholly-owned subsidiary. The percentage of share ownership affects the subsidiary’s accounting, legal influence, and licensing.

For example, in Singapore, to qualify for most of Singapore government funded grants or incentives, there is a rule that 30% ownership must be a local company or an individual.

Is a Subsidiary the Same as a Private Limited Company?

Yes, a subsidiary in Singapore is a type of Private Limited Company (Pte Ltd). It must have fewer than 50 shareholders and cannot publicly trade its shares. In the case of subsidiaries, the shareholder is usually the foreign parent company, making it a corporate shareholder structure. Despite being owned by a foreign entity, the subsidiary operates independently under Singapore law and can fully benefit from local incentives.

Advantages of Setting Up a Subsidiary in Singapore

There are 4 reasons why setting up a subsidiary is the best route for foreign companies looking to expand their operations in Singapore.

Full Foreign Ownership

Singapore allows 100% foreign ownership in private limited companies. No local shareholder is required, although one resident director is mandatory.

For example, A property developer bought new land to develop a new condominium. They will always form a new subsidiary for their new development. This is a form of risk management as a subsidiary is responsible for its own legal liabilities as well as its debts and taxes. It also means that lawsuits against the subsidiary cannot collect against the parent company’s assets, only those of the subsidiary.

Limited Liability

The parent company’s liability is limited to the capital it invested in the subsidiary. Debts and liabilities of the Singapore subsidiary do not legally affect the parent entity.

Tax Benefits

Singapore subsidiaries benefit from:

- A flat 17% corporate tax rate.

- Tax exemptions for new startups under the Start-Up Tax Exemption (SUTE) scheme.

- Avoidance of double taxation through over 90 Double Tax Agreements (DTAs).

- Exemptions on dividends and certain foreign-sourced income.

Business-Friendly Environment

The incorporation process is fully digital, quick, and cost-effective. The regulatory environment is transparent and pro-investment.

Know Your Customer (KYC) Processes for Singapore Subsidiaries

Before you officially open your Singapore subsidiary, it is important to understand the Know Your Customer (KYC) obligations required by both banks and Corporate Service Providers (CSPs). These procedures are essential for due diligence and risk assessment in line with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

KYC Requirements by Banks (for Opening a Corporate Bank Account)

When opening a bank account for your subsidiary, local banks will conduct thorough KYC checks to assess the risk profile of your company. This process determines whether they will approve the account opening. Common KYC information required includes:

- Source of funds: Where the injected capital originates from.

- Business nature: The industry your subsidiary operates in.

- Client profile: Types of customers your subsidiary will engage with and their locations.

- Projected financial activity: Estimated monthly revenue and expenses, both local and overseas.

- Management and control: Who the decision-makers are and whether they are based in Singapore or abroad.

- Local presence: Whether the subsidiary has local staff and physical office premises.

These questions help banks evaluate the operational legitimacy and compliance risk of the business, especially in relation to potential AML concerns.

KYC Requirements by Corporate Service Providers (CSPs)

Since 2016, Singapore’s Accounting and Corporate Regulatory Authority (ACRA) has mandated that all Corporate Service Providers must conduct KYC checks on new clients. This is part of Singapore’s ongoing efforts to prevent illicit financial activity and ensure international AML standards are met.

As part of the incorporation process, all directors and shareholders of both the subsidiary and its holding company must undergo KYC verification. This includes:

- Verification of identity documents (passport, national ID)

- Proof of residential address

- Corporate documents for the parent company (if applicable)

- Professional or business background

These checks must be completed before the registration of the Singapore entity can proceed. Failure to comply or provide adequate documentation may delay or block the incorporation process.

By understanding these KYC requirements early, you can ensure a smoother and more efficient setup for your Singapore subsidiary. Our team will guide you through the process step by step, helping you prepare the required documents and respond to any bank or compliance-related queries effectively.

Filing Annual Returns of a Foreign Subsidiary in Singapore

All locally incorporated companies, including subsidiaries of foreign entities, are required to comply with annual statutory obligations under the Singapore Companies Act, specifically Sections 175, 197, and 201. These include the holding of an Annual General Meeting (AGM) and the filing of annual returns with the Accounting and Corporate Regulatory Authority (ACRA).

During the AGM, the company’s directors must present financial statements that give a true and fair view of the company’s financial position to its shareholders. This is a crucial step in ensuring transparency, accountability, and corporate governance.

While the Companies Act does not specify a minimum qualification for the person preparing the financial statements, it is the directors’ fiduciary duty to ensure that qualified individuals—whether in-house or external professionals—are engaged to prepare accurate and compliant financial accounts.

It is equally important to engage competent corporate secretarial support to help meet all filing deadlines and regulatory requirements. A reliable corporate secretary will ensure that:

- Your AGM is convened within the legally stipulated timeline.

- Your annual return is filed promptly with ACRA.

- Financial statements are prepared in accordance with the Singapore Financial Reporting Standards (SFRS).

Failing to meet annual compliance obligations may result in penalties, enforcement actions, or even the striking off of the company from the ACRA register.

Understanding your annual compliance responsibilities is essential to operating a legally sound subsidiary in Singapore. Our team can assist you in navigating these requirements and maintaining full regulatory compliance year after year.

ACRA Annual Compliance

| Requirements | Descriptions | Companies Act |

|---|---|---|

| Annual General Meeting (AGM) | 1. A company is required to hold its first AGM within 18 months after its incorporation.

2. Subsequent AGMs must be held every calendar year. The interval between AGMs must not be more than 15 months. |

Section 175 |

| Audited/Unaudited Accounts | The Annual Return must be filed with the Registrar within the one-month period following the AGM. | Section 197 |

| Public/Listed Company | For a public company listed or quoted on a securities exchange in Singapore: Accounts presented at the AGM must be made up to a date not more than four months before the AGM.

In the case of any other company: Accounts presented at the AGM must be made up to a date not more than six months |

Section 201 |

Singapore Tax Rates

A company is taxed at a flat rate on its chargeable income regardless of whether it is a local or foreign company.

Tax rates, exemptions, and rebate for each YA

| Year of Assessment(YA) | Tax Rate | Tax Exemption/Rebate |

|---|---|---|

| 2010 onwards | 17% | Partial tax exemption and tax exemption scheme for new start-up companies |

| Companies will continue to enjoy the partial tax exemption scheme and tax exemption scheme for new start-up companies as provided in YA 2008 and YA 2009. | ||

| In addition, with effect from YA 2010, the tax exemption scheme for new start-up companies will be extended to include companies limited by guarantee, subject to the same conditions. |

How to Register a Singapore Subsidiary Company?

To incorporate a Foreign Subsidiary, these are the general requirements and procedures needed:

ACRA Requirements

- Directors: A minimum of one resident director (a Singapore Citizen, a Singapore Permanent Resident, a person who has been issued an EntrePass, Employment Pass, or Dependent Pass) is mandatory.

- Shareholders: The shareholder can be an individual or a corporate entity. 100% local or foreign shareholding is allowed. A director and shareholder can be the same or different person.

- Paid-up Capital: Minimum paid-up capital for registration of a Singapore company is S$1.

- Registered Address: The address must be a physical local address. (PO Box is not allowed.)

- Company Secretary: Companies Act requires one Company secretary who must be a natural person and an ordinarily resident of Singapore.

Documents Required For Company Subsidiary Incorporation

Singapore resident individual shareholder and director:

- Copy of Singapore IC; and

- Copy of passport if the individual is not a citizen of Singapore

Non-resident individual shareholder and director:

- Copy of passport; and

- Copy of residential address proof such as a recent utility bill, residential phone bill, tax bill, or cable TV bill

Corporate shareholder of the Foreign Corporate Company

- Certificate and

- Special Director Resolution to resolve becoming newly incorporated company subsidiary’s shareholder

Please note the following:

- All documents must be in English or officially translated in English;

- All copies of documents must be certified true copies by a notary public or you must bring the originals to our office for sighting;

- If you are overseas, you can email us the scanned copies of documents so we can proceed with preparing the necessary incorporation documents.

- However we must receive the certified true copies (or sight the originals at our office) before we can incorporate the company.

- Our compliance department may ask for additional information if necessary

Once your company is incorporated, you can open a corporate bank account with any of the local and international banks in Singapore.

Frequent Challenges When Registering a Subsidiary

Even with Singapore’s streamlined registration process, many businesses encounter avoidable roadblocks. Here are the most common:

Incomplete or Incorrect Documentation

Failure to provide notarized and translated documents or mismatch in parent company details may lead to rejection or delays.

Misunderstanding Legal Responsibilities

Many companies overlook the need for:

- Maintaining accounting records that comply with IRAS and ACRA requirements.

- Appointing a qualified company secretary.

- Filing taxes and annual returns on time.

3. Choosing the Wrong SSIC Code

An incorrect SSIC code can lead to license application issues or denial of tax incentives. Certain SSIC codes also require pre-approvals from other government bodies (e.g. MAS, MOH).

4. Appointing a Resident Director

Foreign owners must appoint a local director who is a Singapore resident. This may require engaging nominee director services. Without this, incorporation cannot proceed.

5. Cultural and Operational Integration

Successfully operating in Singapore requires understanding local market behaviors, adapting business models, and complying with local employment and HR laws. Misalignment can hinder market penetration and employee retention.

6. Self-Registration Missteps

Singapore does not allow foreigners to self-register a company without a licensed filing agent. Many mistakenly try to complete the process themselves, only to encounter system access or legal document issues.

FAQs

Firstly, choose a company name and register it with ACRA. Then, submit the incorporation documents and pay the registration fee. Once approved, you’ll receive a Certificate of Incorporation.

A: To incorporate a subsidiary company in Singapore, you must first register with the Accounting and Corporate Regulatory Authority (ACRA) or contact with us.

Yes, you can use a different name for your subsidiary. Your subsidiary name doesn’t have to be the same as the parent company name.

There is no requirement for the parent company of a subsidiary to have been incorporated in Singapore. Although a certificate of incorporation is required by the authorities, this certificate may be received from the authorities of the country in which the parent company had been incorporated.

Singapore’s tax laws define companies which are Singapore tax residents to be those which are managed and controlled in Singapore. This is defined by the location in which board meetings are held. Therefore, all companies which primarily hold board meetings in Singapore are Singapore tax residents.

There are no rules stating that a foreign subsidiary cannot be a sole proprietorship. It is a rare occurrence because most foreign subsidiaries are private limited companies. However, it is indeed possible for a foreign subsidiary to be a sole proprietorship.

About The Author

Share This Story, Choose Your Platform!

Related Business Articles

We are wanting to setup a bank account in Singapore. Is the best way to incorporate there? What are charges to setup a subsidiary and the process.

Hello Parry,

If you have already incorporated your company in Singapore, you may proceed to open a bank account there.

For the establishment of a subsidiary in Singapore, the ACRA registration fee is S$315. We offer affordable packages which will ensure that your business is established in a suitable manner.

For any further information on incorporation or corporate bank accounts, you may contact us; we will be able to be of assistance.

Thank you.

Paul