When a foreign company wants to start a business overseas, the first thing comes to their mind is forming a subsidiary. Let dive in and understand what is and how to register a Singapore subsidiary.

What is a Singapore Subsidiary Company?

A Singapore subsidiary company is a private limited company where the majority shareholder is a corporate entity own by their parent or holding company normally located from overseas jurisdiction.

After the subsidiary is formed, there is a relationship between a parent company (simply, a parent) and its subsidiary (or subsidiaries) in which the parent controls its subsidiary. This is in terms of the ability to influence and direct the financial and operating policies of the subsidiary to the benefit and best interest of the parent.

Shares Ownership of a Subsidiary

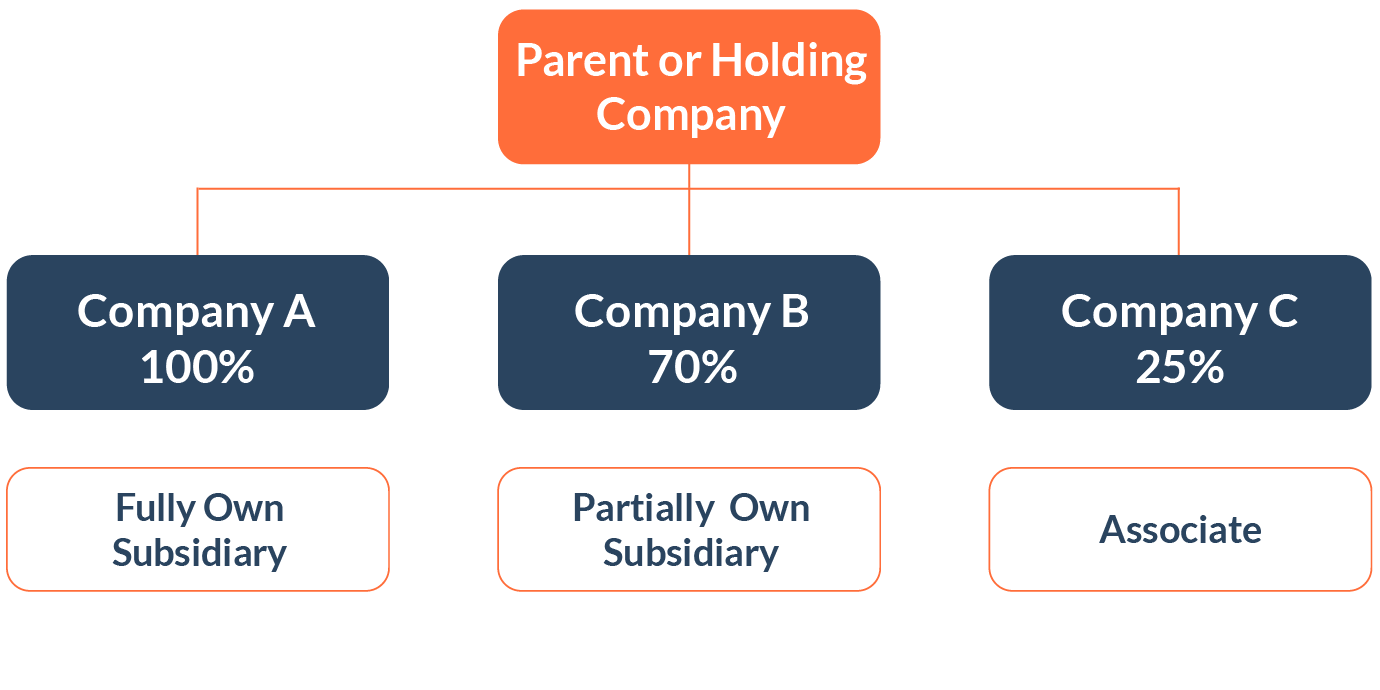

To be considered a subsidiary, there must be a minimum 50% of share ownership by their foreign parent or holding company. It also means that the minimum parent share ownership is between 50% to 99% only.

The remaining 1% to 50% of the shares can be held by either an individual or corporate legal entity such as a partnership, sole proprietorship, or any other legal entity.

If the parent has 100% share ownership of their subsidiary, it is considered a wholly-owned subsidiary. The differences lie in the percentage of shares ownership, and this will affect the accounting, legal influence, licensing of the subsidiary.

For example, in Singapore, to qualify for most of Singapore government funded grants or incentives, there is a rule that 30% ownership must be a local company or an individual.

Why do foreign companies form a Subsidiary?

There are 2 reasons why setting up a subsidiary is the best route for foreign companies:

1) Separate from parent company

The parent company wants venture into a new business in a different industry and perhaps even a different branding. Forming a subsidiary will result in an independent legal and financial entity that separates them from their parent company.

For example:

A property developer bought new land to develop a new condominium. They will always form a new subsidiary for their new development. This is a form of risk management as a subsidiary is responsible for its own legal liabilities as well as its debts and taxes. It also means that lawsuits against the subsidiary cannot collect against the parent company’s assets, only those of the subsidiary.

2) Too many different and large volumes of individual shareholders under parent company

It is unpractical to form a new company using the parent company’s individuals as shareholders. In relationship to the above, the parent company may want to form or already have hundreds of subsidiaries. Henceforth, when there a change in parent shareholdings, it wouldn’t be practical to alter shares of so many subsidiaries

Know Your Customer (KYC) Processes for Singapore Subsidiaries

We at Paul Hype Page & Co always do our best to give realistic expectations to our future and existing clients. We also adhere to the local laws and regulations to provide the best service possible.

Before opening your subsidiary office, we will guide you through the challenges you might face.

Know Your Customer (KYC) Conducted by the Bank for opening a bank account

KYC information comprises the facts about customers, the bank needs to collate such information to assess on whether they want to accept this client for account opening.

These facts enable the bank to assess company’s risks on include money laundering and terrorist financing.

Common questions on “Know their customers’ KYC list are as followings:

Know Your Customer (KYC) Conducted by ACRA Corporate Service provider (CSP)

Since 2016, ACRA has implemented the rule that all Corporate Service Providers need to conduct KYC on new clients as part of the Anti Money laundering Act. Therefore, every director and shareholder of the subsidiary and Holding company will be subjected to the KYC process prior to registration of the Singapore subsidiary or company. Below infographics provide some information:

Filing annual returns of a foreign subsidiary

All locally incorporated companies are required to hold an Annual General Meeting (AGM) and file annual returns under S175, S197, and S201 of the Companies Act. At the AGM, directors are to present a true and fair view of the company’s accounts to their shareholders.

The Companies Act does not prescribe the minimum level of qualification for the person preparing the accounts. However, it is the responsibility of the directors to appoint individuals with the required level of expertise for the preparation of such accounts. Having said that, it is important to have the right secretarial support to ensure you’ve met all regulatory requirements.

Understand the ACRA Annual Compliance needed to be perform yearly

| Requirements | Descriptions | Companies Act |

|---|---|---|

| Annual General Meeting (AGM) | 1. A company is required to hold its first AGM within 18 months after its incorporation.

2. Subsequent AGMs must be held every calendar year. The interval between AGMs must not be more than 15 months. |

Section 175 |

| Audited/Unaudited Accounts | The Annual Return must be filed with the Registrar within the one-month period following the AGM. | Section 197 |

| Public/Listed Company | For a public company listed or quoted on a securities exchange in Singapore: Accounts presented at the AGM must be made up to a date not more than four months before the AGM.

In the case of any other company: Accounts presented at the AGM must be made up to a date not more than six months |

Section 201 |

Singapore Tax Rates

A company is taxed at a flat rate on its chargeable income regardless of whether it is a local or foreign company.

Tax rates, exemptions, and rebate for each YA

| Year of Assessment(YA) | Tax Rate | Tax Exemption/Rebate |

|---|---|---|

| 2010 onwards | 17% | Partial tax exemption and tax exemption scheme for new start-up companies |

| Companies will continue to enjoy the partial tax exemption scheme and tax exemption scheme for new start-up companies as provided in YA 2008 and YA 2009. | ||

| In addition, with effect from YA 2010, the tax exemption scheme for new start-up companies will be extended to include companies limited by guarantee, subject to the same conditions. |

How to Register a Singapore Subsidiary Company?

To incorporate a Foreign Subsidiary, these are the general requirements and procedures needed:

ACRA Requirements

Documents Required For Company Subsidiary Incorporation

For each Singapore resident individual shareholder and director:

For each non-resident individual shareholder and director:

For each corporate shareholder of the Foreign Corporate Company Certificate and

Special Director Resolution to resolve becoming newly incorporated company subsidiary’s shareholder

Please note the following:

Once your company is incorporated, you can open a corporate bank account with any of the local and international banks in Singapore.

FAQs

Yes, you can use a different name for your subsidiary. Your subsidiary name doesn’t have to be the same as the parent company name.

There is no requirement for the parent company of a subsidiary to have been incorporated in Singapore. Although a certificate of incorporation is required by the authorities, this certificate may be received from the authorities of the country in which the parent company had been incorporated.

Singapore’s tax laws define companies which are Singapore tax residents to be those which are managed and controlled in Singapore. This is defined by the location in which board meetings are held. Therefore, all companies which primarily hold board meetings in Singapore are Singapore tax residents.

There are no rules stating that a foreign subsidiary cannot be a sole proprietorship. It is a rare occurrence because most foreign subsidiaries are private limited companies. However, it is indeed possible for a foreign subsidiary to be a sole proprietorship.

We are wanting to setup a bank account in Singapore. Is the best way to incorporate there? What are charges to setup a subsidiary and the process.

Hello Parry,

If you have already incorporated your company in Singapore, you may proceed to open a bank account there.

For the establishment of a subsidiary in Singapore, the ACRA registration fee is S$315. We offer affordable packages which will ensure that your business is established in a suitable manner.

For any further information on incorporation or corporate bank accounts, you may contact us; we will be able to be of assistance.

Thank you.

Paul