Outline

A Certificate of Incumbency is issued by a business entity containing the names of all current directors of a company which is based there. In certain instances, it may also contain the names of the most important shareholders of the company.

The primary use of a Certificate of Incumbency is to verify the identity of an individual who has been performing legally binding transactions in the name of the company.

What is a Certificates of Incumbency in Singapore

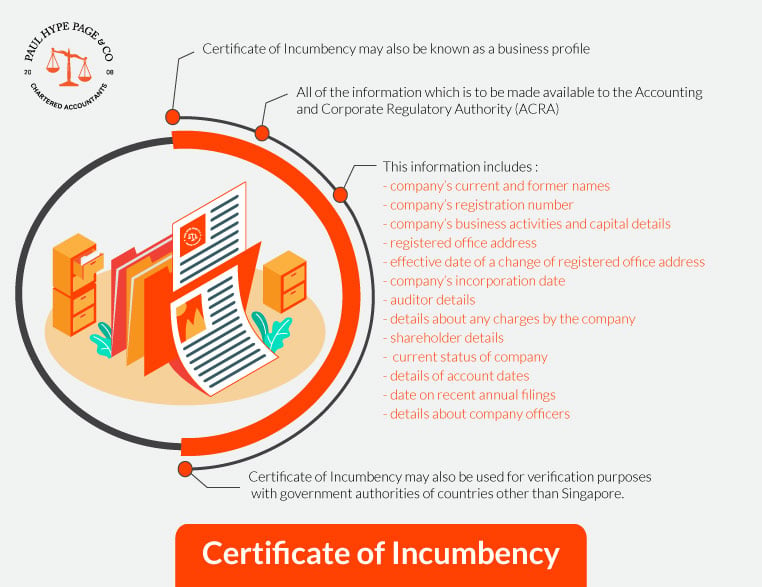

In Singapore, a Certificate of Incumbency may also be known as a company’s ACRA business profile. Every Singapore incorporated company has a Certificate of Incumbency automatically issued upon registration. It is the most common business document used for verification.

This information includes:

When a Certificate of Incumbency in Singapore Can Be Used

A non-exhaustive list of common occurrences a Certificate of Incumbency is used in Singapore:

Certificates of Incumbency are particularly useful for those who plan to open a Singapore corporate bank account from abroad and are either unable or unwilling to personally go to Singapore in order to open such an account.

Other documents required for a bank account opening:

In most cases, the company’s signatories are to have signed an official document from either the Registrar of Companies or the government in the presence of the bank’s staff members before the bank account can be opened.

If such did not happen, all signatures are to be duly approved by a notary public, a High Commissioner or Ambassador of Singapore, or an external authorised signatory of one of the bank’s branches in a country other than Singapore.

Certificates of Incumbency and Offshore Bank Accounts

Many look to Singapore for offshore company registration and bank accounts for the management of their finances which may be kept in bank accounts spanning multiple countries. However, in order to ensure that the person who is opening the offshore bank account is not doing so for any illicit purposes, the authorities require certain documents to be presented. One such document is the Certificate of Incumbency.

Another important document to be submitted for the opening of an offshore bank account is the Certificate of Good Standing. The Certificate of Good Standing provides the authorities with ample verification that a particular company has been authorized to conduct business activities and has been legally incorporated in a particular jurisdiction.

When used and submitted in conjunction with a Certificate of Incumbency, it is possible for the owner of a company based in Singapore to open an offshore bank account without facing any notable difficulties. Thus, Certificates of Incumbency assist in the opening of bank accounts of all types.

Of course, before anyone can make use of or even possess a Certificate of Incumbency, a company will first have to be incorporated. If you would like to have a Singapore company of your own incorporated, we at Paul Hype Page & Co are able to make it so that such will be done.

Our incorporation experts will work with you throughout the entire process of Singapore company incorporation. Should your company be in need of a nominee director, a company secretary, or both, we will also select a person who is suitable for each necessary role in order to fulfil the requirements specified by Singapore’s company laws.

FAQs

You can engage with an expert from Paul Hype Page. Paul Hype Page is a Full Practicing Member of the institute of Certified Public Accountants of Singapore (ICPAS) and also registered as a Public Accounting Firm with Accounting and Corporate Regulatory Authority (ACRA).

If your company has an unusual financial year period (52 weeks for example), you should notify ACRA.

Every business owner must register his/her business with ACRA as long as he/she is conducting any activity for profit continuously unless:

- The business is conducted under one’s full name as reflected in NRIC.

- The business is conducted under one or more partners using their full names as reflected in their NRICs.

An individual must be 18 years old to register a business with ACRA.

ACRA stands for Accounting and Corporate Regulatory Authority of Singapore.

You need to provide the following information when you file the annual return:

- Company details

- Shares

- Financial Statements

- Date of Annual General Meeting (if applicable)

All companies that are incorporated in Singapore are required to file annual returns with ACRA as per the Companies Act.

It depends on the size of your company. If your company has only 1 director, then this director is the only person who needs to acknowledge on documents submitted with the annual returns; if your company has more than 1 director, your company will need at least 2 directors to acknowledge on documents submitted with the annual returns

Your company will be fined for S$300 late lodgement fee should you submit the annual returns after the deadline.

The process for a foreigner to register a company in Singapore is similar to that of a local, with the exemption of the need to apply for an Employment Pass to physically be and work in Singapore.

You can read more about it here.

There are three types of banks in Singapore: traditional local bank, traditional foreign bank, and digital bank.

All documents submitted must be in English. For all non-English documents, the company must ensure all documents are translated into English by an official translator and certified by the directors of the company who are to sign on every page of such documents.

Yes. You can open a corporate bank account with any bank located in Singapore.

Digital bank is generally safe in Singapore.

All documents submitted must be in English. For all non-English documents, the company must ensure all documents are translated into English by an official translator and certified by the directors of the company who are to sign on every page of such documents.

There are three types of banks in Singapore: traditional local bank, traditional foreign bank, and digital bank.

Yes. You can open a corporate bank account with any bank located in Singapore.

About The Author

Share This Story, Choose Your Platform!

Related Business Articles