If you are planning to relocate and incorporate your company in Singapore, gaining a comprehensive understanding of the Employment Pass (EP) system is essential for a smooth transition.

The Singapore Employment Pass (EP) is a work visa specifically tailored for foreign professionals, managers, executives, and specialists who are looking to work in Singapore. As a result, this pass enables qualified individuals to legally reside and work in the country, therefore granting them access to one of the world’s most vibrant business hubs. Moreover, it plays a critical role for entrepreneurs and professionals who wish to contribute their expertise and expand their businesses within Singapore’s dynamic and rapidly growing economy. In essence, the EP offers a clear pathway to long-term career success in one of Asia’s leading business destinations. To summarize, it provides professionals with the opportunity to thrive in an economically progressive environment.

How Do I Qualify for Singapore Employment Pass?

To qualify for an Employment Pass in Singapore, applicants need a minimum salary of SGD 5,000, relevant experience, and recognized qualifications. Employers must justify hiring foreign professionals, ensuring EP holders contribute to Singapore’s economy.

Related Read: How To Use CPF for Homeownership in Singapore: An Essential Guide 2024

Eligibility Criteria for Employment Pass (EP) in Singapore

To work and reside in Singapore as a foreign professional, you must first meet the eligibility requirements for an Employment Pass (EP), a work visa issued by Singapore’s Ministry of Manpower (MOM).Specifically, the EP is designed for professionals, managers, executives, and specialists, requiring candidates to meet key criteria — including a minimum monthly salary, relevant academic qualifications, and specialized skills or experience. Moreover, the hiring company must sponsor the application and comply with fair hiring practices.By fulfilling these requirements, applicants can ensure a smooth application process and gain access to Singapore’s dynamic workforce and thriving economy.

Our Singapore Employment Pass Services

With extensive expertise in employment pass applications across Singapore, Malaysia, Indonesia, and Hong Kong, we specialize in securing Singapore Employment Passes (EP) for professionals and businesses. Our in-depth knowledge of Singapore’s EP requirements and proven success in navigating complex applications make us the trusted partner for employers and employees alike. Let us guide you through a smooth and efficient process, ensuring your EP approval is quick and hassle-free.

Experienced Business Consultants

Our 2 Decades of Proven Expertise Will Guide Your Business

With over two decades of experience across Singapore, Malaysia, Indonesia, and Hong Kong, we have successfully facilitated the incorporation of more than 2,000 companies across diverse jurisdictions. Notably, our expertise in Singapore is demonstrated by our high success rate in securing work passes and navigating complex regulatory frameworks — which stands as a testament to our unwavering commitment to client success. As a result, we have earned the trust of businesses as reliable advisors, leveraging strategic networks and deep market insights. Ultimately, we ensure seamless incorporation processes and establish a strong foundation for sustainable growth in Singapore’s competitive business environment.

What is COMPASS?

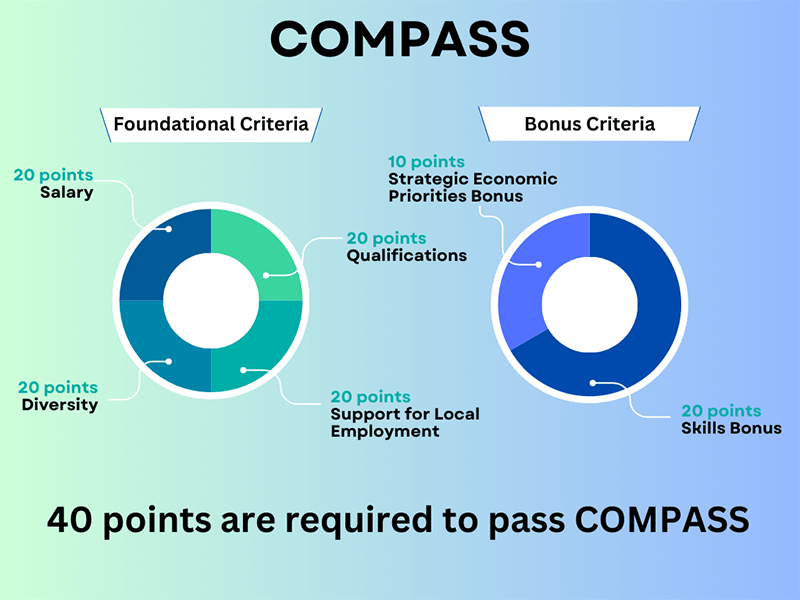

On September 1, 2023, Singapore introduced the Complementarity Assessment Framework (COMPASS), a transformative point-based system designed to evaluate Employment Pass (EP) applications. COMPASS aims to ensure that foreign professionals complement the local workforce by meeting key criteria aligned with Singapore’s economic and workforce priorities.

Under COMPASS, EP applicants are assessed through a two-stage eligibility framework. Firstly, in the first stage, basic requirements are evaluated, which include a minimum qualifying salary and relevant academic qualifications. Once these are met, the second stage comes into play, involving a point-based system that considers individual attributes such as skills, experience, and qualifications. Moreover, company-related aspects are also assessed, including workforce diversity, contribution to local employment, and alignment with strategic industry needs.

This system will also apply to the renewal of EPs starting September 1, 2024, making it essential for both new and renewing applicants to align with the framework’s requirements. COMPASS underscores Singapore’s commitment to building a competitive yet inclusive workforce, ensuring that foreign talent adds value to the nation’s vibrant economy.

Starting September 1, 2023, only eligible EP applications included criteria with minimum salary requirements based on the applicant’s age.

Sectors Excluding Financial Services

- At the age of 23 with a qualifying salary of $5,000.

- Qualifying salary increases by $250 according to each subsequent age.

- At age 45 and above, the qualifying salary will be up to $10,500.

The Financial Services Sector

- At the age of 23 with a qualifying salary of $5,500.

- At age 45 and above, it will be up to $11,500.

Compass is a point-based system. EP applicants must score at least 40 points based on individual or firm attributes to qualify.

Foundational Criteria: Earn up to 20 points per criterion

- Salary: Fixed monthly salary compared to local PMET salaries in sector by age

- Qualifications: Based on candidate’s qualifications

- Diversity: Share of candidate’s nationality among firms PMETS.

- Support for Local Employment: Firm’s share of local PMETs within its subsector

Bonus Criteria: Fail to hit 40 points? Here are bonus points awarded to applications that meet these conditions.

- Skill Bonus: Specialized skills that are in short supply within the local workforce.

- Strategic Economic Priorities Bonus: Grants companies for approved strategic initiatives like ambitious investment, internationalization efforts, and innovative endeavors endorsed by the National Trades Union Congress (NTUC) for workforce transformation.

COMPASS is a point-based evaluation system. To be eligible, EP applicants must score a minimum of 40 points, assessed across both individual and employer-related attributes. Specifically, points are allocated based on factors such as the applicant’s qualifications, experience, and salary, as well as the employer’s workforce diversity, support for local employment, and alignment with strategic industries. For more details, see the breakdown of the points based on employer and applicant criteria.

How Can I be Exempted from Compass?

You don’t need to go through COMPASS if you met any of these criteria:

- A fixed monthly salary at a minimum value of $22500

- Currently applying as an overseas intra-corporate transferee

- Will be holding the role for less than 1 month

Employment Pass Application Checklist

Checklist for a successful EP Application

Singapore Immigration & Visa Guides

Gain insight into immigration for a smooth move to Singapore with our expertly crafted articles drawn from our experience.

Discover the latest updates and requirements for the Singapore Employment Pass in our comprehensive guide, covering changes from 2024 to 2025. Gain insights into eligibility criteria, application processes, and more.

Here are key differences working visa for foreigners in Singapore, based on your conditions.

A common question we often receive from foreigners is about registering a company with an employment pass in Singapore.

Discover three pathways for migrating to Singapore and explore why relocating to this vibrant city-state is an appealing prospect for foreigners.