Establishing a company in Singapore and registering a business is an exhilarating endeavor, offering boundless opportunities for both local entrepreneurs and foreign investors alike. Whether you’re a dynamic Singaporean with innovative ideas or an ambitious foreigner seeking to tap into Singapore’s vibrant business landscape, the journey of business registration is filled with excitement and promise. In this guide, we will walk you through all the necessary documents, steps to register a company, and what you need to do after you register your business in Singapore.

5 Easy Steps to register your business

STEP 1 : UNDERSTAND REQUIREMENTS FOR COMPANY REGISTRATION IN SINGAPORE

Establishing a company in Singapore can be an exciting endeavor. Whether you are a local Singaporean or a foreigner, specific guidelines and requirements exist that business owners must fulfil to register a company. However, there are also some key differences in the business registration process for locals and foreigners, which can impact the timeline and complexity of the procedure.

Things to take note when registering in ACRA:

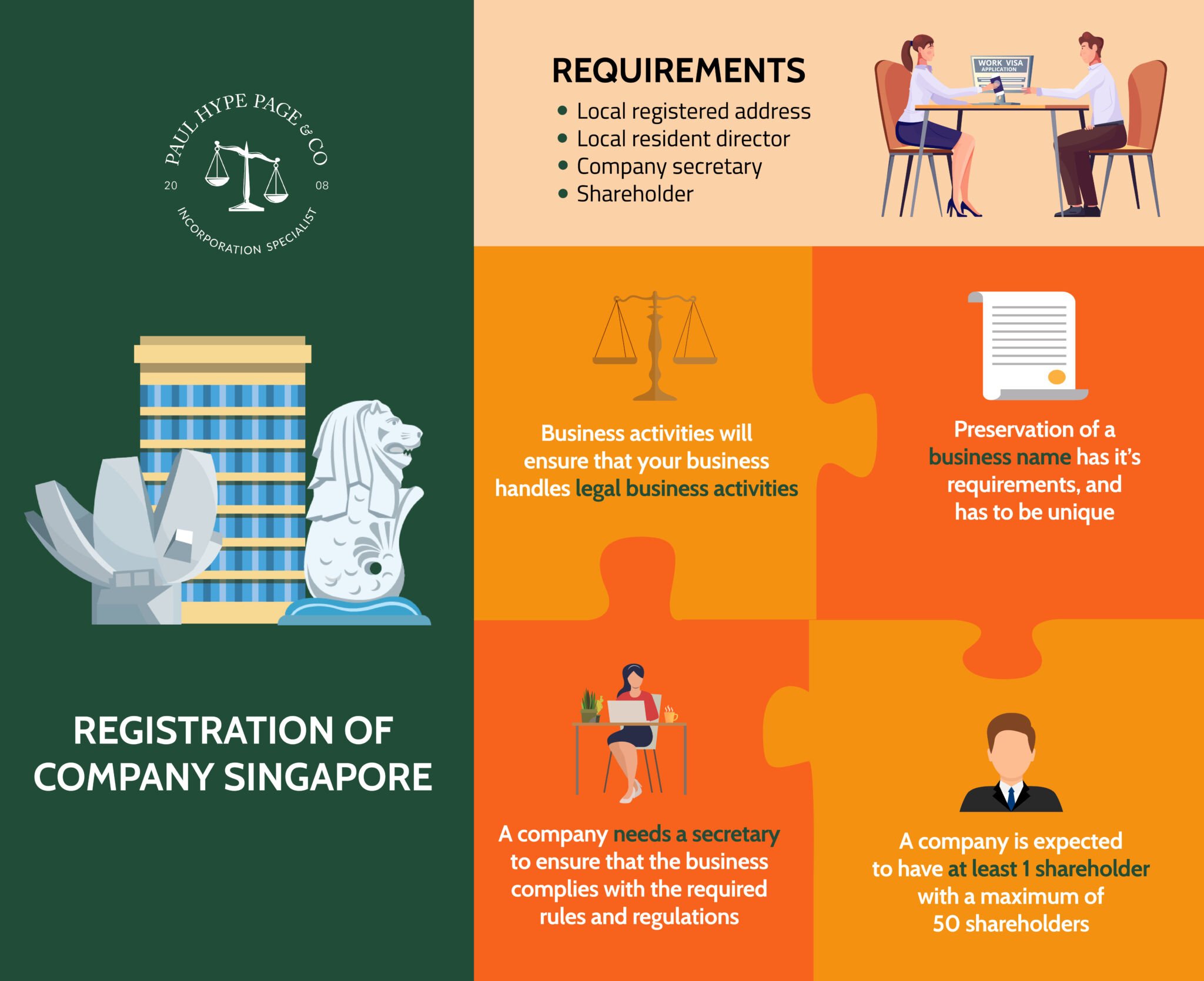

The basic requirements to open a company is to have:

- At least one local resident director

Both Singapore residents and foreigners can serve as directors of a Singapore company, provided there is at least one director who is a Singapore resident. If you don’t have a Singapore-resident person to act as the director, you can use our nominee director service to satisfy this requirement. - At least one shareholder

To register a company in Singapore, you need at least one shareholder who can be a person or another company. You can have up to 50 shareholders, and all of them can be foreigners. - Local company secretary

Every Singapore company must have a company secretary who lives in Singapore. The company secretary is responsible for ensuring the company meets its regulatory requirements and submits necessary filings. When you register your company through us, we can appoint a company secretary for you. - Minimum of $1 Paid up Capital

You can establish your Singapore company with just $1 in paid up capital and share capital. If needed, you can add more funds later and inform the company registrar. - Registered Address in Singapore

Your company needs a registered address in Singapore where all the official documents will be sent to ; a PO box isn’t acceptable. When you use our registration service, we can help you provide our address as your company’s registered address.

There are also other necessary documents required for registration, which typically include:

- Company Constitution or Memorandum and Articles of Association

- Identification documents of shareholders and directors

- Registered office address

- Details of company officers

STEP 2 : IDENTIFY YOUR BUSINESS STRUCTURE

The next step in registering a company in Singapore involves determining its corporate structure. Before proceeding with the registration process, it’s crucial to decide on the most suitable structure for your company.

Key questions to consider include:

- Who will be the shareholders and what portion of shares will each hold?

- Who will serve as directors, including the resident director in Singapore?

- Will a nominee director service be needed?

- What will be the initial share capital?

To comply with Singapore’s company registration rules, it’s essential to gather and confirm the identification and background details of potential shareholders and directors. This involves providing proof of identity and relevant background information as per the regulations.

For individual shareholders, the required documents include a copy of their passport, Singapore ID if they live in Singapore, proof of residential address (such as a driver’s license, utility bill, or rental agreement), and a professional background description, such as a resume.

For corporate shareholders, the necessary documents include the certificate of incorporation of the parent company, a business profile detailing its activities, share capital, shareholders, and officers, an ownership structure chart identifying the Ultimate Beneficial Owners (UBO), and a board resolution from the parent company authorizing the establishment of a subsidiary in Singapore.

The most common types of business profiles are:

Sole Proprietorship:

Ownership: The business is owned and operated by a single individual who has full control and responsibility.

Taxation: The income of the business is taxed as personal income for the owner. This means that the owner is personally liable for all taxes and debts incurred by the business.

Private Limited Company (Pte Ltd):

Ownership: Ownership is divided into shares held by shareholders. The number of shares owned determines the extent of ownership in the company.

Taxation: The company is taxed as a separate legal entity at corporate tax rates. Shareholders may also be taxed on any dividends received from the company, but they are not personally liable for the company’s debts beyond their share capital contribution.

Public Limited Company (Ltd):

Ownership: Similar to private limited companies, ownership is divided into shares held by shareholders. However, shares of public limited companies can be traded publicly on a stock exchange.

Taxation: Public limited companies are also taxed as separate legal entities at corporate tax rates. Shareholders may be subject to personal income tax on dividends received. Like private limited companies, shareholders are not personally liable for the company’s debts beyond their share capital contribution.

STEP 3 : RESERVE YOUR COMPANY NAME

Once you’ve chosen your business structure, you need to reserve a unique name for your new business. The name must comply with the guidelines set by the Accounting and Corporate Regulatory Authority (ACRA).If your chosen name includes certain terms like media, bank, law, finance, or education, an external government authority may need to review it.

To enhance the likelihood of immediate approval, it’s important to ensure that the name is NOT:

- Similar or identical to an existing company in Singapore

- Vulgar or obscene

- Already reserved before

Moreover, You can choose to reserve a company name ahead up to 120 days before your company registration and once you submit it, they will confirm you back within a day on whether it is approved or rejected.

While locals may navigate Singaporean naming conventions with ease, foreigners often benefit from consulting with local experts to ensure compliance. Access our free tool to effortlessly verify the availability of your desired company name:

STEP 4 : SIGN INCORPORATION DOCUMENTS

Once the name has received approval, you need to sign, and submit the following documents to ACRA:

- Company Constitution

- Consent of Company Directors

- Consent of Company Secretary

- Declaration of the company’s controllers

As your appointed registration agent, we will prepare all necessary documents. All you have to do is review and electronically sign the documents through an online portal. It’s as simple as that!

STEP 5 : REGISTER YOUR COMPANY IN ACRA

To register you company you will need to login to ACRA Bizfile Portal. Inside the ACRA’s BizFile Portal, you can register and upload the necessary documents of your company.

Make sure that you know your primary business activity and find the Singapore Standard Industrial Classification (SSIC) Code that is required by ACRA to complete your company registration. You can have a maximum of two SSIC codes. Usually, a company applies for one SSIC code but if your business spans multiple areas, you have the option to apply for an additional SSIC code. Then, You may specify your company’s primary and secondary business activities.

After your Company is registered:

After you register your business through ACRA’s Bizfile, you will receive an email notification on your e-certificate of incorporation. It will take around a few hours to a few days depending on the nature of your company. This is the official Singapore Company Incorporation Certificate but if you want a hard copy of it, you can request it online for just S$50.

Next, If you are a Foreigner and want to establish a presence in Singapore or reside in the country, you must apply for Work Visas either Employment Pass, Entrepass or Onepass. You must ensure that you comply with visa and work pass requirements for yourself and for any foreign employees that you will be hiring in your company.

For local entrepreneurs, the post-incorporation phase also requires attention in certain details. Ensure that you adhere to local tax regulations and business licensing requirements and keep an eye on any necessary permits. An advantage for local entrepreneurs is that they can apply for MRA Grant! MRA Grant from Singapore Government covers up to 70% of eligible costs.

Next Steps:

Open Corporate Bank Account

After you incorporate a business, you will need to open a corporate bank account in Singapore to facilitate business transactions.

A local Singaporean may already have a relationship with a bank, while a foreigner may need to do some research to find a financial institution that can meet their business needs. We recommend to approach local corporate specialist to guide you through this process and ensure that all necessary steps are taken to successfully open a Bank Account in Singapore.

Applying for Business License

Depending on the nature of the business, specific licenses may be required. This can include licenses related to industries like finance, healthcare, and education. Make sure to thoroughly research and understand the licensing obligations before you start a company in Singapore.

Registering for Goods and Service Tax (GST)

If your company annual turnover exceeds $1 million, you must register for GST. This can be done by submitting an application to the Inland Revenue Authority of Singapore (IRAS).

Form C or Form C-S – Tax Filing with IRAS

Companies must file their income tax returns using either Form C or Form C-S with the IRAS. The choice between the two forms depends on the company’s annual revenue and other criteria.

According to IRAS, If you don’t do the tax filing, you may be fined with $1000 including owed taxes. If the tax filings are more than 2 years or more, the penalty can be up to two times the tax amount.

Annual General Meeting

Companies are required to hold an AGM to present financial statements and appoint auditors. It is important to maintain accurate financial records and have your financial statements audited annually by a qualified auditor.

Apply For The MRA Grant

Considering expanding globally? Applying for MRA Grant offered by the Singapore government is a great first step.

This grant covers up to 70% of eligible costs, such as market research and business development expenses, a significant financial support for SMEs looking to expand globally.

However, these criteria must be met by a Singaporean to apply for MRA Grant:

- Global headquarters should be in Singapore, meaning the company must have a significant presence and operations here.

- The annual turnover of the company must be less than S$100 million annually, supporting SMEs rather than large corporations.

- At least 30% of local shareholding

- Below S$100,000 in overseas sales in each of the last 3 preceding years for the new target market

Foreigners keen on the grant must incorporate a Singaporean subsidiary or register a branch office. Additionally, having a Singaporean shareholder with at least a 30% stake is mandatory.

With the right guidance, registering a company in Singapore is a smooth process, regardless of nationality. Coupled with the MRA grant, SMEs can seize global expansion opportunities and thrive not just in Singapore but beyond.

Benefits of Incorporating a company in Singapore

Incorporating a company in Singapore has become a trend and an attractive option for foreign companies to incorporate a business in Singapore. Here are some key advantages of register your business in Singapore:-

Tax Benefits

Singapore is one of countries with lowest corporate tax rates in the world. It also has business-friendly tax rates and tax polices such as double taxation avoidance agreements (DTA) and tax-exempted profits.

Political Stability and Business-Friendly Environment

Singapore has a stable political environment and a strong legal framework. The government is known for its pro-business policies, low corruption levels, and efficient regulatory system. This creates a favorable business environment, instilling confidence in investors and entrepreneurs.

Access to Global Markets

Singapore is an international hub with prime location among the South East Asia countries. With its open economy and numerous free trade agreements, it’s easy to enjoy access to a wide range of global markets. The city-state’s strategic location and well-established trade ties make it an ideal base to start a company in Singapore

Talented Workforce

There are a lot highly skilled and multicultural workforce, contributing to innovation, professional service and business growth. The high standard of living, excellent healthcare, and diverse cultural amenities make Singapore an attractive destination for both businesses and their employees.

Ease of Doing Business

The city-state consistently ranks high in global ease of doing business indices, reflecting its efficient bureaucracy and straightforward regulatory processes. It also has a well-established legal system based on English common law, providing a reliable framework for business operations. These provide incentives for new companies to establish their companies in Singapore

FAQs

Once your company is registered in Singapore, you can proceed to open a corporate bank account by providing the necessary documents to the chosen bank, such as the company’s registration number and incorporation documents.

Foreign companies can engage an incorporation service provider to handle the company registration process on their behalf and do not need to travel to Singapore for this purpose.

The corporate bank account opening process for a registered company in Singapore involves providing the required documents to the chosen bank, such as the company’s registration number, incorporation documents, and the appointment of authorized signatories.

The requirements for company incorporation in Singapore include appointing at least one director who is a Singapore citizen or permanent resident, appointing a company secretary within six months of company incorporation, and having a registered office address in Singapore.

The incorporation process for a company in Singapore is fast and can be completed within one to two days, provided that all the necessary documents and information are prepared.

The annual filing requirements for a registered Singapore company include filing annual returns with the Accounting and Corporate Regulatory Authority (ACRA), holding an annual general meeting, and preparing financial statements in accordance with the Singapore Financial Reporting Standards.

Yes, a company from overseas can relocate to Singapore and register as a Singapore company by engaging in the company registration process and fulfilling the necessary requirements.

About The Author

Share This Story, Choose Your Platform!

Related Business Articles